Allstate Home and Renters Insurance Review

Allstate's home insurance is a better deal than its renters insurance. However, it could take a long time for Allstate to pay your claim after damage.

Find Cheap Homeowners Insurance Quotes in Your Area

Is Allstate insurance good?

Allstate home insurance is a good choice if you want a wide variety of coverage options, ranging from flood insurance to coverage for your Airbnb.

Homeowners insurance from Allstate is typically affordable. However, it has poor customer service reviews. That means you may have to pay more to fix your home, and it could take a while for Allstate to send you a check to repair the damage.

Allstate renters insurance typically isn't the cheapest option. Its lack of discounts and coverage options mean most people can find a better policy elsewhere.

In addition, Allstate may not be the best choice for people looking to bundle their home or renters policy with car insurance. That's because its car insurance is typically expensive, so the savings from bundling may not save you money overall.

Editor's rating | |

|---|---|

| Home insurance | |

| Renters insurance |

Pros and cons

Pros

Affordable home insurance with many coverage options

Helpful home insurance discounts

Offers coverage for vacation rentals

Cons

Few renters insurance coverage options or discounts

Difficult claims process

Home insurance not available in California

Allstate home insurance review

Allstate's home insurance is good for its low prices and great coverage options.

However, its poor customer service ratings indicate you may have to pay more to repair damage to your home.

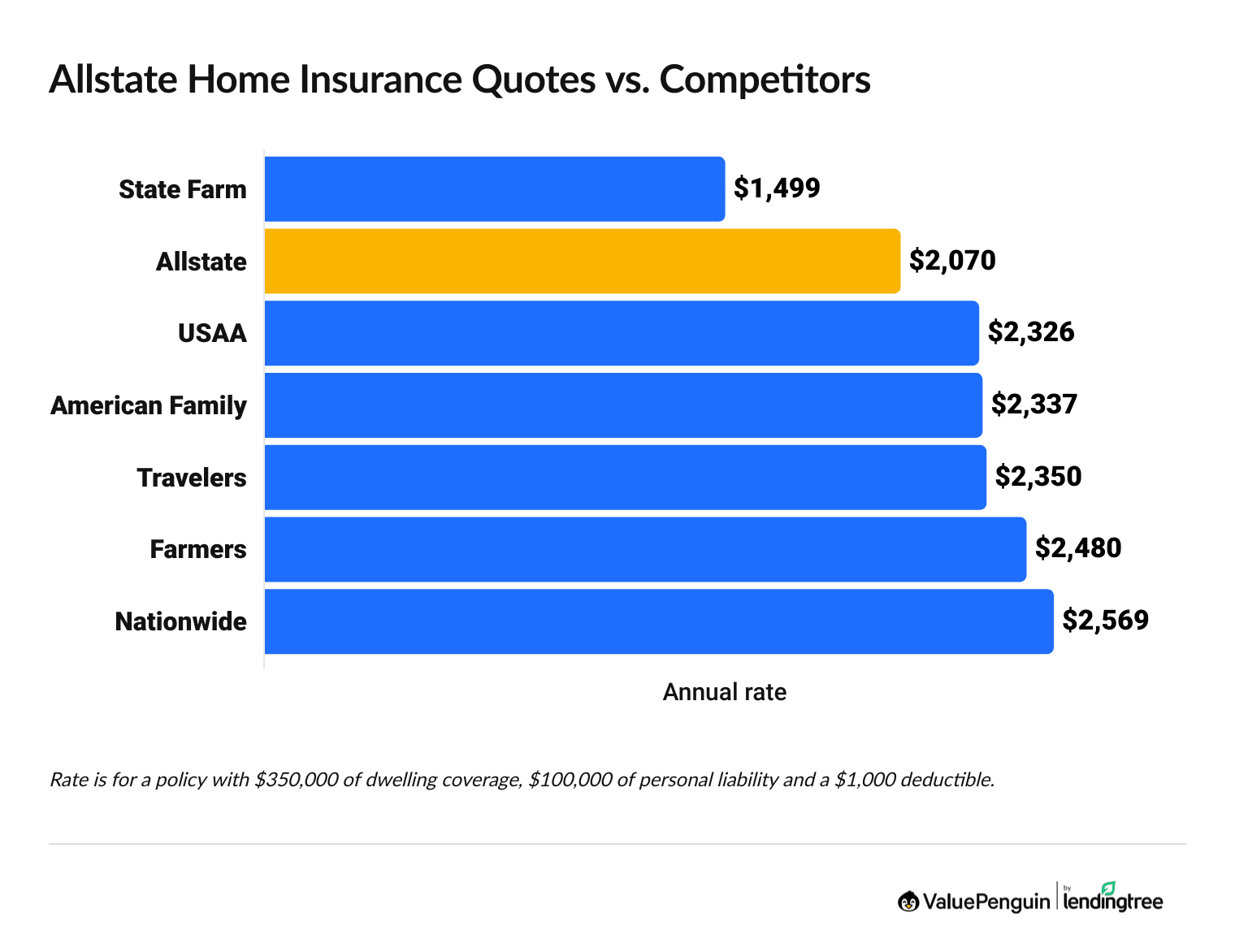

Allstate home insurance quote comparison

Home insurance from Allstate is typically a better deal for people with more expensive homes.

For example, an Allstate policy with $1 million of dwelling coverage costs an average of $4,574 per year. That's 13% cheaper than the national average.

However, $200,000 of dwelling coverage costs around $1,491 per year from Allstate, which is 2% more expensive than average.

Overall, Allstate home insurance costs around 6% less than average.

Find Cheap Homeowners Insurance Quotes in Your Area

Homeowners who don't need much dwelling coverage can typically find cheaper rates at State Farm or midsize companies like Erie and Cincinnati.

Compare Allstate homeowners quotes by dwelling coverage limit

$200,000

$350,000

$500,000

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,076 | ||

| Allstate | $1,491 | ||

| American Family | $1,564 | ||

| Farmers | $1,566 | ||

| Travelers | $1,567 | ||

*USAA is only available to military members, veterans and their families.

$200,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,076 | ||

| Allstate | $1,491 | ||

| American Family | $1,564 | ||

| Farmers | $1,566 | ||

| Travelers | $1,567 | ||

*USAA is only available to military members, veterans and their families.

$350,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,499 | ||

| Allstate | $2,070 | ||

| USAA* | $2,326 | ||

| American Family | $2,337 | ||

| Travelers | $2,350 | ||

*USAA is only available to military members, veterans and their families.

$500,000

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $1,954 | ||

| Allstate | $2,618 | ||

| USAA* | $2,930 | ||

| Travelers | $3,154 | ||

| American Family | $3,155 | ||

*USAA is only available to military members, veterans and their families.

$1 million

Company | Annual rate | ||

|---|---|---|---|

| State Farm | $3,257 | ||

| Allstate | $4,574 | ||

| USAA* | $4,760 | ||

| American Family | $5,681 | ||

| Travelers | $5,885 | ||

*USAA is only available to military members, veterans and their families.

Allstate home insurance is a good deal in many states. Allstate is the cheapest home insurance company in Indiana, Louisiana, Michigan, Mississippi and Nevada.

However, Allstate can be very expensive in some areas. An Allstate policy costs at least 35% more than average in Iowa, Maine, Montana and Virginia.

Allstate homeowners insurance discounts

Allstate has many home insurance discounts that could lower your rates by hundreds of dollars per year.

For example, you can save up to 25% when you bundle Allstate home and auto insurance policies. That could be a savings of around $518 per year for a home with $350,000 of dwelling coverage.

Save when you switch to Allstate without having a recent home insurance claim.

Get a discount when you buy a policy at least a week before your current policy ends.

Get a discount when you sign up to make automatic payments.

Save money if you recently bought a home or own a newly constructed home.

Save money when you renew your Allstate policy.

Save up to 25% if you bundle home and car insurance.

Get a discount if you have a history of paying on time or in full.

Earn a discount when you install anti-theft or fire protection devices.

Save money when you switch to Allstate from another insurance company.

Allstate customers in Florida can save money if they have hurricane shutters or other wind mitigation features. That's because these features can help protect their homes against storms.

Allstate's discounts vary by state, so you may only be able to get some of these discounts in your state.

Allstate Enhanced Package

The Allstate Enhanced Package is an optional program that could reduce what you pay for home insurance in the future. It locks in your rates even if you file a claim and gets you additional savings for each year you go claim-free. You must pay to sign up, but it can help you save in the long run.

Allstate's Enhanced Package has three benefits:

- Claim RateGuard keeps your home insurance rates from going up after you file a claim.

- Claim-free bonus gives you a 5% discount each year you renew without having a claim.

- Deductible rewards lower your deductible by $100 each year you don't have a claim, up to $500.

Paying for the package is worth it if you expect the savings to exceed the sign-up cost. However, you must add the Enhanced Package within 60 days of buying your policy to get the $100 deductible reward when you renew.

Allstate home insurance coverage

Allstate has more coverage options than most companies. These add-ons can help you customize your home policy.

For example, if you use your home as an Airbnb or short-term rental, you can use Allstate's HostAdvantage option for additional protection against theft and damage. Not all major insurance companies offer protection for short-term rentals.

Covers business items that you keep in your home, including inventory.

Helps pay to recover lost personal computer data.

Protects valuable items like jewelry, antiques and artwork. Basic homeowners insurance typically offers limited coverage for these items.

Covers the extra cost for energy-efficient appliances or other items when replacing them after damage and a claim.

Helps you manage your digital footprint and resolve identity fraud. This includes identity monitoring and restoration, and identity theft reimbursement.

Offers extra coverage for expensive musical instruments.

Homeowners can upgrade their policies to ensure they get enough money to replace damaged or broken things with brand-new items. This is known as replacement cost coverage.

For example, instead of covering a 7-year-old fridge at its current value, Allstate will pay for a brand-new fridge.

This type of home insurance upgrade can be worth it if you're concerned about rising costs during inflation.

Allstate's HostAdvantage covers up to $10,000 in property damage and will help replace belongings stolen by short-term renters.

Protects costly equipment like bicycles, golf clubs or skis.

Allstate water backup coverage helps pay for water damage from a drain backup or broken sump pump.

Extra coverage for trees, landscaping, lawn mowers and other features in your yard.

Plus, Allstate offers the standard homeowners insurance coverages that other insurance companies do:

Another benefit of Allstate is its set of free digital tools that help homeowners better understand how insurance works. This is especially helpful for first-time homebuyers.

Anyone can use these tools, not just Allstate customers. They provide shoppers with valuable info about their home insurance costs and risks.

For example, the Common and Costly Claims tool allows you to search your ZIP code to see the claims made most frequently. This can help you prepare for those risks.

Allstate renters insurance review

Allstate usually isn't the best choice for renters insurance.

Its rates are average, and it offers fewer discounts and coverage add-ons than many other companies. In addition, Allstate has fairly poor customer service reviews.

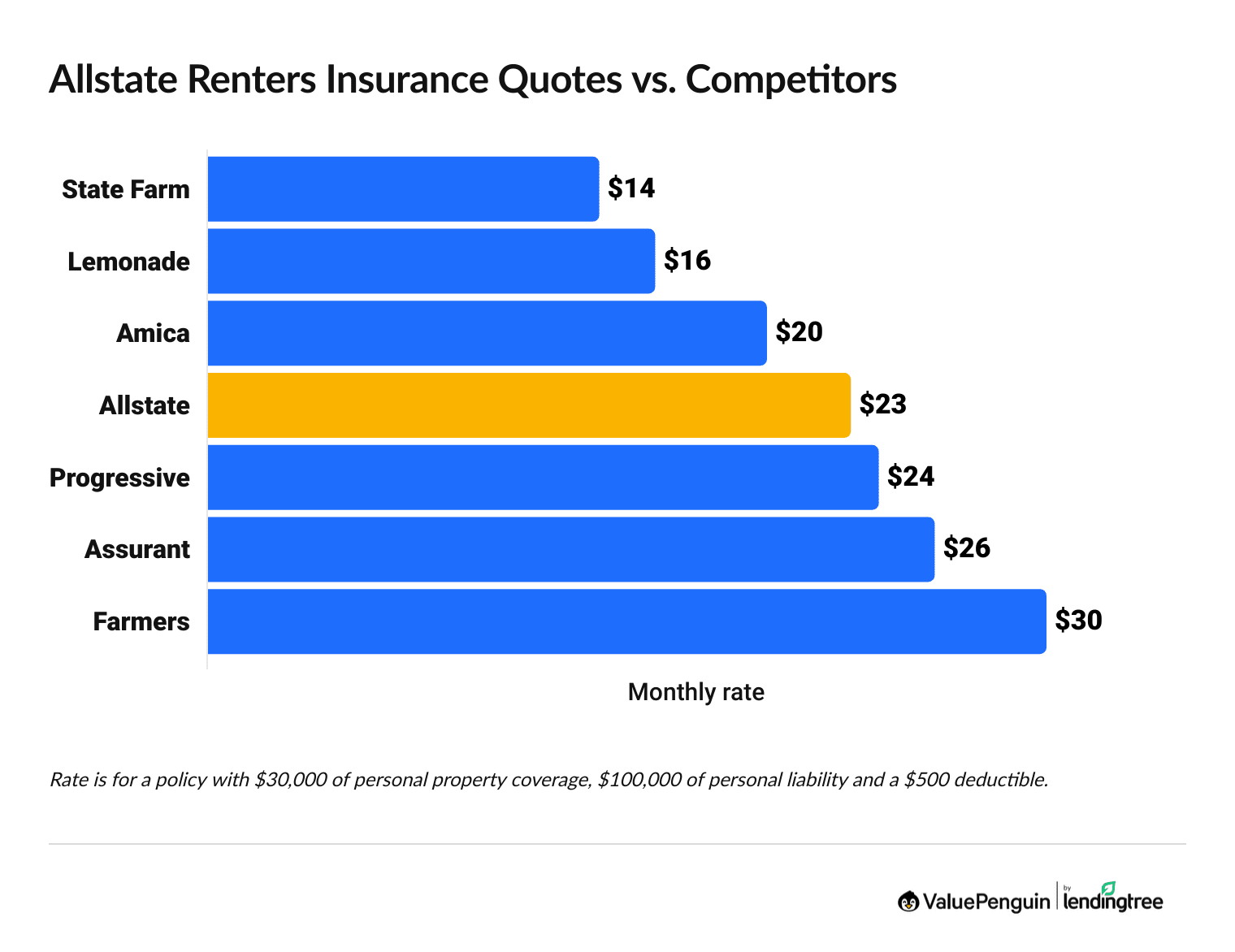

Allstate renters insurance quotes

Allstate doesn't usually have the cheapest renters insurance. The average cost of a renters insurance policy from Allstate is $23 per month, which is the same as the national average.

Renters can typically find more affordable rates at State Farm, Lemonade and Amica. All three of these companies also have superior customer service reviews compared to Allstate. So they're probably a better choice for most people.

Find Cheap Homeowners Insurance Quotes in Your Area

Compare renters insurance quotes: Allstate vs. competitors

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $14 | ||

| Lemonade | $16 | ||

| Amica | $20 | ||

| Allstate | $23 | ||

| Progressive | $24 | ||

Allstate renters insurance discounts

Allstate offers a few ways to help renters save on their insurance. But it doesn't have as many discounts as other major insurance companies. Allstate discounts include:

- Bundle discount: Save money when you buy both renters and car insurance from Allstate.

- Easy pay plan discount: Get a discount when you sign up to pay your monthly bill automatically.

- 55 and retired discount: Save up to 25% if you're over 55 and don't have a full-time job.

However, you can't save money by installing an alarm system or buying your policy online, which are common discounts at other companies.

If you're renting a home or apartment in Florida, you can also save money if your home or building has certain features that protect against wind damage. This can include items such as storm shutters or impact-resistant windows and doors.

Allstate renters insurance coverage

Allstate's basic renters insurance policy comes with enough coverage for most people — including personal property, personal liability and loss of use coverage.

However, compared to other companies, Allstate offers very few ways to upgrade your renters insurance policy with extra protection.

Allstate's coverage add-ons for renters insurance include:

- Scheduled personal property, which gives you extra protection for valuable items such as jewelry, sports equipment or musical instruments.

- Identity theft, which helps pay for legal fees and other costs if someone steals your identity.

- Umbrella policy, which pays for damage or injuries you cause that exceed the personal liability insurance limits on your renters insurance policy.

- Flood insurance, which pays for damage caused by weather-related flooding from rainwater, storm surge, or overflowing lakes and rivers.

If you want popular coverage add-ons such as replacement cost coverage, water backup coverage or pet protection , you should consider another company.

Allstate reviews and complaints

Customer reviews of Allstate home and renters insurance aren't great.

Allstate gets 7% more complaints about its home insurance than a typical company of its size. Most complaints are about low claims settlement offers and a lengthy claims process. That means it may take a while for Allstate to pay your claim, and it could cost more to fix your home or replace your stuff after damage occurs.

Allstate insurance ratings

Score | |

|---|---|

| J.D. Power home insurance | 14th out of 24 companies |

| J.D. Power renters insurance | 10th out of 16 companies |

| J.D. Power claims satisfaction | 13th out of 16 companies |

| NAIC complaint index | 7% more complaints than average |

| AM Best financial strength | A+ |

Allstate also earned low scores on J.D. Power's home and renters customer satisfaction studies. That means customers aren't particularly happy with the company's service.

Many customers buy Allstate home insurance through local insurance agents. Even when you buy a policy online, your local agent will help you file a claim or change your policy.

This can be an advantage because you can avoid large call centers and get more personalized service from someone local. However, it also means your experience with Allstate will vary based on where you live and the agent you have.

On a positive note, Allstate earned a financial strength rating of A+ from AM Best. That means homeowners don't have to worry about Allstate's ability to pay customer claims after a major emergency.

Filing a claim with Allstate

Your Allstate agent should be the first person you call when filing a homeowners insurance claim. They will give you instructions and be able to answer any questions you might have.

However, you can also file a claim through the Allstate website or by calling Allstate's claims division.

- Allstate customer service phone number: 1-800-ALLSTATE (1-800-255-78283)

- Allstate home claims phone number: 1-800-255-7828

You'll usually need photos of the damage, details about the incident and contact info for contractors who are already involved. The type of claim will determine if an adjuster comes to your home to estimate the damage.

Other insurance available from Allstate

Allstate is one of the largest insurance companies in the U.S. That means you can get many types of insurance, including:

- Boat

- Business

- Condo

- Earthquake

- Event and wedding

- Flood

Frequently asked questions

Is Allstate a good homeowners insurance company?

Allstate is a good choice for home insurance. Its rates are cheaper than most major companies, and it offers a variety of coverage add-ons. However, Allstate's customer reviews are not as good as other highly rated home insurance companies like State Farm or Erie.

Is Allstate selling homeowners insurance in Florida?

Yes, Allstate offers homeowners insurance in Florida through its subsidiary, Castle Key Insurance. It has some of the cheapest home insurance in Florida at around $2,561 per year for a home with $350,000 of dwelling coverage.

Is Allstate homeowners insurance cheaper than State Farm?

No, Allstate home insurance is not cheaper than State Farm. State Farm is one of the

Is Allstate renters insurance good?

Allstate renters insurance isn't great. The company has average renters insurance rates, few discounts and poor customer service. Most people can find better rates and coverage elsewhere.

Methodology

To compare Allstate quotes for home insurance, ValuePenguin gathered rates across residential ZIP codes in all 50 states. Rates are for a home with $200,000, $350,000, $500,000 and $1 million of dwelling coverage, along with the following coverage limits:

- Personal liability coverage: $100,000

- Medical payments: $5,000

- Deductible: $1,000

ValuePenguin's homeowners insurance analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should only be used for comparative purposes. Your quotes may be different.

To compare Allstate renters insurance rates, ValuePenguin editors gathered quotes from major cities across every state in the U.S. Rates are for an unmarried 30-year-old woman with no roommates or pets and no history of insurance claims.

Quotes include the following coverage limits:

- Personal property: $30,000

- Personal liability: $100,000

- Medical payments: $1,000

- Deductible: $500

Additional sources include J.D. Power, AM Best and the National Association of Insurance Commissioners (NAIC).

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.