How Much Does It Cost to Insure a Dodge Charger?

The Dodge Charger is a popular American sports car and is noted as one of the last great sports sedans.

It costs $2,635 per year to insure the 2021 Dodge Charger SXT, which equates to about $220 a month.

Find Cheap Dodge Charger Insurance Quotes

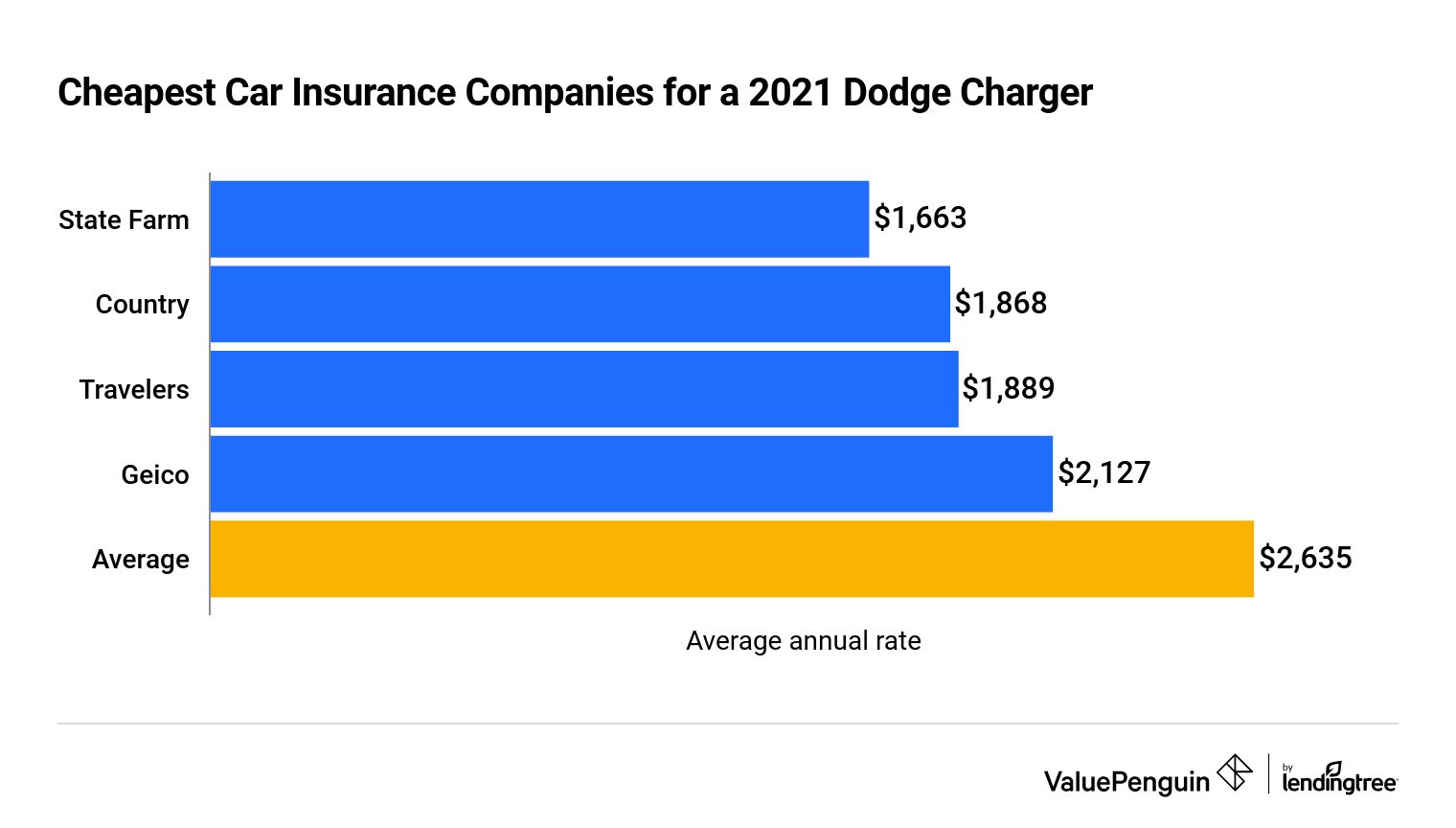

The cheapest insurer for this luxury vehicle is State Farm. The market value of a 2021 Dodge Charger SXT is $26,975.

It's important to compare insurance quotes across multiple insurers to find the best insurance rate for your Dodge Charger.

Cheapest insurance company for the Dodge Charger: State Farm

State Farm is the cheapest major insurer for the Dodge Charger, with a rate of $1,663 per year. State Farm customers with a 2021 Dodge Charger will save $2,165 per year compared to Allstate, which is the most expensive large insurance company for the Charger.

Find Cheap Dodge Charger Insurance Quotes

Travelers is the second-cheapest large insurer, costing just $18 more per month than State Farm to insure the 2021 Dodge Charger.

Cheapest car insurance companies for a 2021 Dodge Charger

Company | Annual rate | Monthly rate | |

|---|---|---|---|

| State Farm | $1,663 | $139 | |

| Country Financial | $1,868 | $156 | |

| Travelers | $1,889 | $157 | |

| Geico | $2,127 | $177 | |

| American Family | $2,657 | $221 |

Our sample driver is a 30-year-old, single man with a clean driving record. These insurance rates reflect quotes for a full coverage policy across every ZIP code in Illinois.

How much is car insurance for a Dodge Charger?

On average, the cost to insure a Dodge Charger is $2,392 per year. Insurance rates will vary based on model year and vehicle value. Newer models are often more expensive, which is why insurance rates steadily increase.

Out of the models surveyed, the 2014 Dodge Charger is the cheapest to insure, at $2,067 per year. That’s $568 per year cheaper than the 2021 Dodge Charger. Insurance cost data for the 2022 Dodge Charger was not available at the time this article was written, but insurance for a newer model is likely to cost more.

Average cost of Dodge Charger insurance by year model

Vehicle | Market value | Average Dodge Charger car insurance price |

|---|---|---|

| 2021 Dodge Charger | $26,975 | $2,635 |

| 2020 Dodge Charger | $26,557 | $2,577 |

| 2019 Dodge Charger | $25,512 | $2,543 |

| 2018 Dodge Charger | $22,551 | $2,458 |

| 2017 Dodge Charger | $18,676 | $2,389 |

| 2016 Dodge Charger | $15,685 | $2,278 |

| 2015 Dodge Charger | $13,495 | $2,185 |

| 2014 Dodge Charger | $9,195 | $2,067 |

Insurance rates represent the annual cost of a full-coverage policy for a 30-year-old male driver for a Dodge Charger SXT. The insurance rates were gathered from every ZIP code in Illinois.

Vehicles with extra features can cost more to repair — and insure — than base models of that same vehicle.

Cost of coverage for the Dodge Charger SXT and Dodge Charger GT

This article analyzes insurance quotes for both the base SXT model and the more powerful GT, but there is only a slight difference in insurance cost between the SXT and the GT. Insurance for the Dodge Charger GT is actually $1 less per month.

Model | Average insurance cost | Market value (2021) |

|---|---|---|

| Dodge Charger SXT | $2,635 | $26,975 |

| Dodge Charger GT | $2,618 | $32,418 |

The Dodge Charger GT is a more expensive model with a more powerful engine. Types of trim can include different sets of features for the vehicle, which can often set the car's value. The trim level can also help predict the potential cost to insurers in the event of an accident. For example, the 2021 Dodge Charger SRT Hellcat has a market value of $78,573, which is $51,598 more than the 2021 Dodge Charger SXT. Because of this, 2021 Dodge Charger Hellcat owners will likely pay hundreds more per year for insurance than Dodge Charger SXT owners.

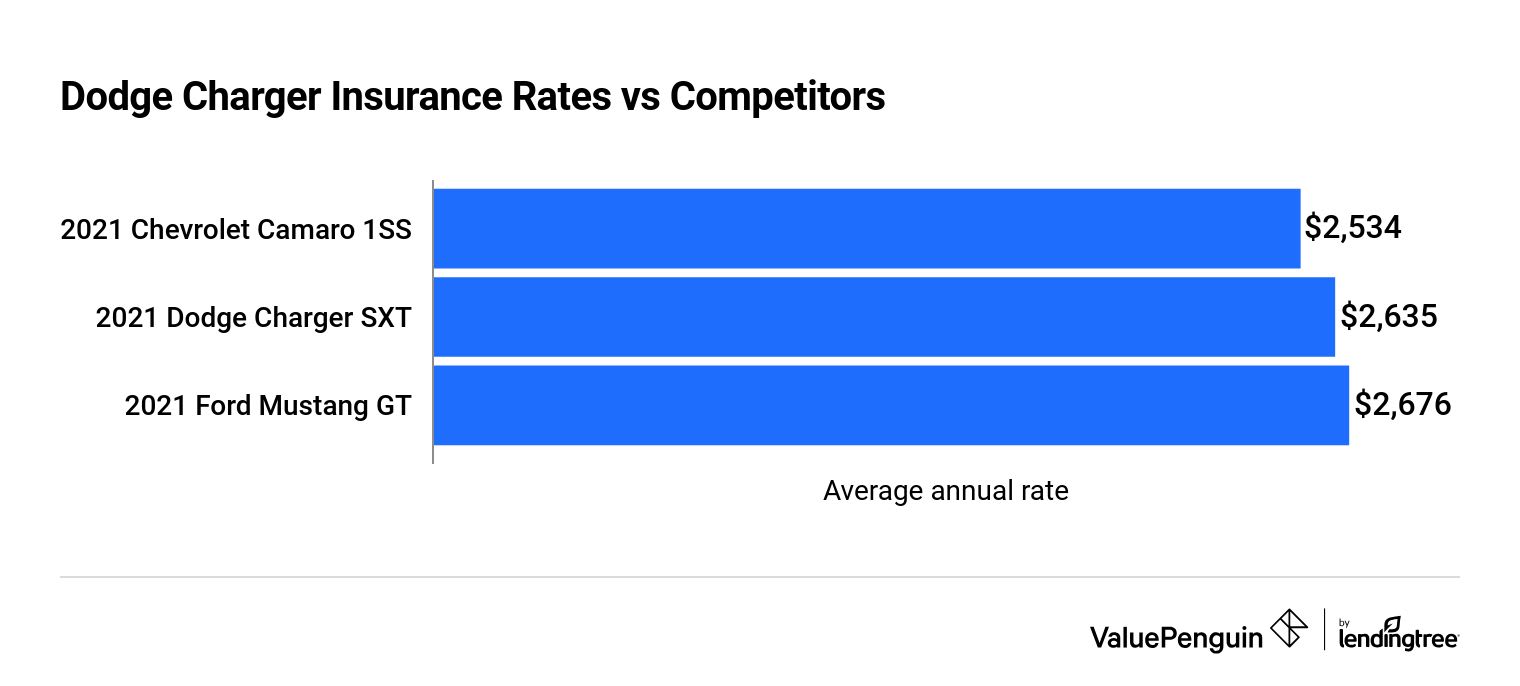

How Dodge Charger insurance costs compare to other muscle cars

Compared to other types of popular muscle cars on the market, the 2021 Dodge Charger's insurance rates can be a bit more expensive at $2,635 a year.

The same sample driver was used to find insurance rates for muscle-car competitors compared to the Dodge Charger. The cost to insure a 2021 Chevy Camaro 1SS is $100 cheaper annually than the cost to insure a Dodge Charger, which is a mere $8 difference per month. The 2021 Ford Mustang is the most expensive, costing $2,676 to insure per year.

Average insurance cost of Dodge Charger vs competitors

Model | Annual rate | Monthly rate |

|---|---|---|

| 2021 Chevrolet Camaro 1SS | $2,534 | $211 |

| 2021 Dodge Charger SXT | $2,635 | $220 |

| 2021 Ford Mustang GT | $2,676 | $223 |

Methodology

Our sample driver was a 30-year-old single man with a clean driving record. The rates, which were collected from every ZIP code in Illinois, reflect the cost of the full coverage policy outlined below.

Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different.

Dodge Charger average market values were from Kelley Blue Book.

Managing Editor

Ben Breiner is the Managing Editor of ValuePenguin/LendingTree's insurance vertical. He oversees a team of writers who focus on guiding readers through the rigors of home and auto coverage. He still loves that moment when the words fall together and he can translate an intimidating topic so a reader can make the best choice.

Ben got involved in insurance in 2021 when he joined ValuePenguin. He moved up from writer to editor and watched the team grow to expand the ways it helps consumers. Before that, he spent a decade as a sportswriter for newspapers in the Southeast and Midwest.

Ben had to put off buying his first car because of high insurance rates, so he's keenly aware how the wrong policy can get in the way of your goals. He should've shopped around and looked to the experts.

Insurance tip

Always keep an eye out for insurance you can load up on at a low price. A lot more liability coverage won't break the bank and protects your hard-earned assets.

Expertise

- Car insurance

- Home insurance

- Renters insurance

Education

- BA, Economics and Journalism, University of Wisconsin-Madison

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.