The Best Cheap Car Insurance for New Drivers

State Farm has the best cheap car insurance for new drivers. New drivers under 25 pay around $276 per month for full coverage from State Farm.

Find Cheap New Driver Car Insurance Quotes

Best cheap insurance for new drivers

ValuePenguin collected thousands of car insurance quotes from every ZIP code in Texas to find the best and cheapest insurance for new drivers. Rates are for new drivers ages 16, 17, 18, 21, 25, 35, 45 and 55, and a 16-year-old, 18-year-old or 21-year-old on a policy with his two 50-year-old parents.

First-time drivers pay more for car insurance because they have less experience on the road and are more likely to cause a crash.

New drivers under 25 years old pay an average of $725 per month for their own full coverage insurance. However, new drivers who share a policy with their parents, family or roommates can pay a lot less for car insurance.

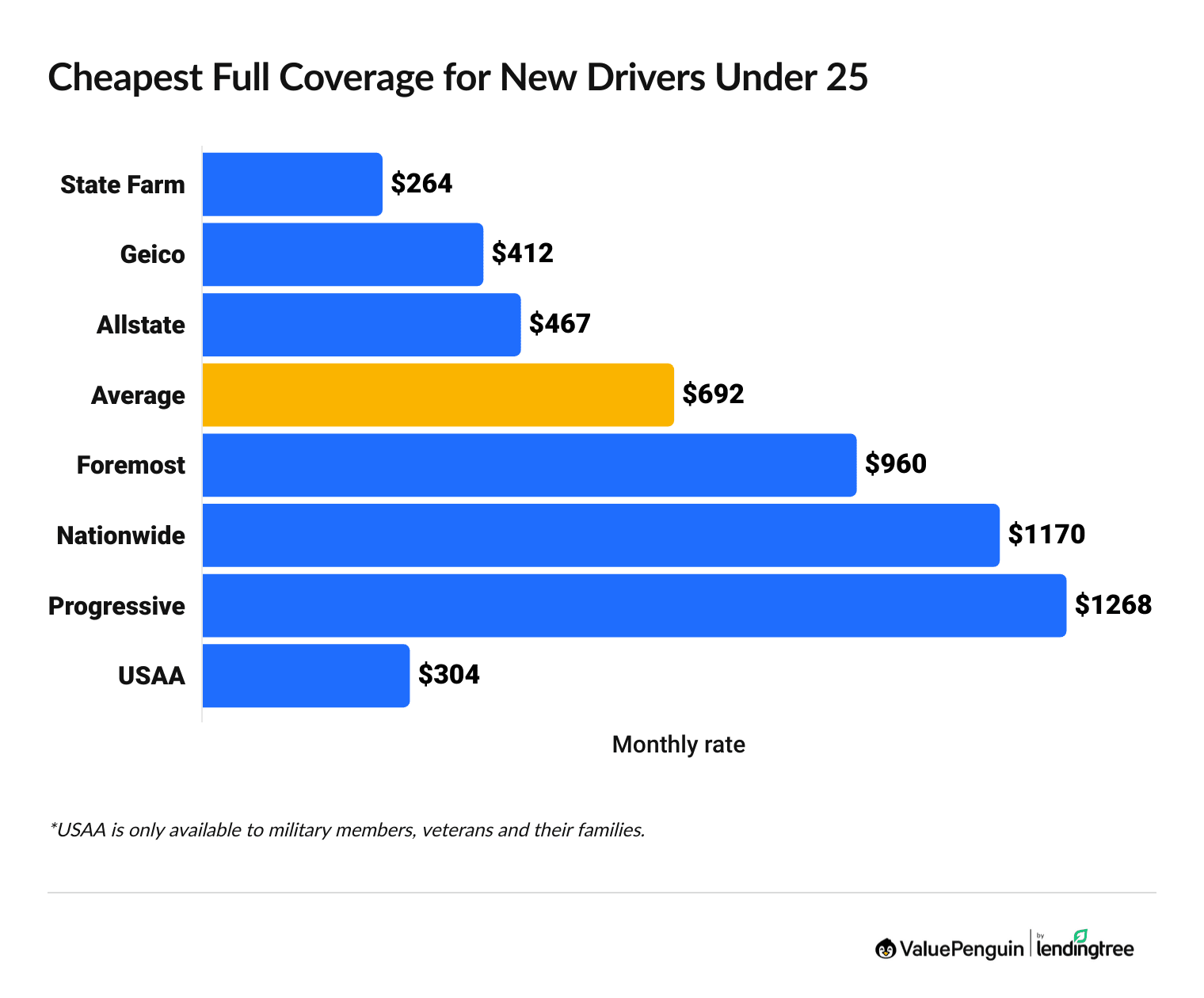

Best car insurance for new drivers under 25

State Farm has the best cheap car insurance for drivers under 25 with their own policy.

Full coverage from State Farm costs young first-time drivers around $264 per month. That's less than half the average monthly rate, which is $692. This makes State Farm the best car insurance company for new drivers.

Allstate has the best cheap minimum coverage insurance for young drivers. It offers the most affordable liability-only car insurance rates for first-time drivers under 25 years old. On average, new drivers can expect to pay $204 per month for minimum coverage from Allstate. That's less than half the average cost for new drivers.

Cheap car insurance for first-time drivers

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $293 | ||

| Geico | $413 | ||

| Allstate | $466 | ||

| Farmers | $959 | ||

| Nationwide | $1,171 | ||

| USAA* | $329 | ||

*USAA is only available to current and former military members and their families.

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $293 | ||

| Geico | $413 | ||

| Allstate | $466 | ||

| Farmers | $959 | ||

| Nationwide | $1,171 | ||

| USAA* | $329 | ||

*USAA is only available to current and former military members and their families.

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Allstate | $204 | ||

| State Farm | $152 | ||

| Geico | $194 | ||

| Farmers | $451 | ||

| Nationwide | $686 | ||

| USAA* | $138 | ||

*USAA is only available to current and former military members and their families.

What kind of car insurance should new drivers get?

Minimum coverage policies are the cheapest type of car insurance for new drivers. That's because they include the lowest amount of coverage you can legally have in your state.

However, liability insurance only pays for injuries to other drivers and damage to their vehicle or property if you cause a crash. It doesn't pay for your car repairs or medical bills.

If you get into an accident and only have minimum coverage, you'll have to pay for your own repairs and medical bills. A full coverage auto insurance policy can protect you against this scenario.

Keep in mind that full coverage will cost more.

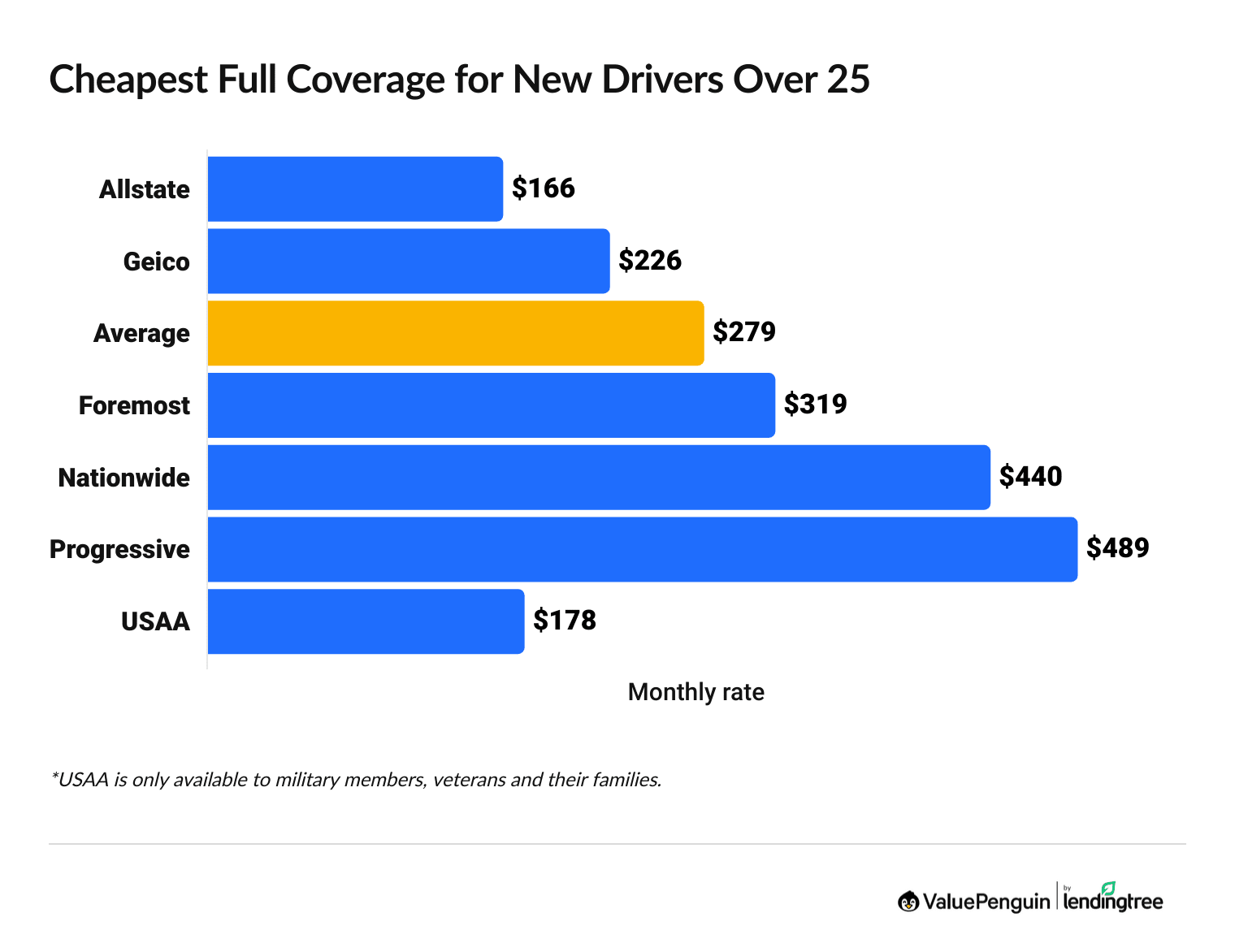

Best car insurance for new drivers over 25

State Farm has the cheapest full coverage car insurance for new drivers over 25 years old. New drivers with State Farm pay $135 per month. That would save $144 per month from the nationwide average.

Find Cheap New Driver Car Insurance Quotes

First-time drivers older than 25 can find the cheapest minimum coverage auto insurance with Allstate. The company charges $67 per month. That's less than half the national average.

Cheap car insurance for new drivers over 25

Full coverage

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $135 | ||

| Allstate | $166 | ||

| Geico | $226 | ||

| Nationwide | $440 | ||

| Farmers | $319 | ||

| USAA* | $178 | ||

*USAA is only available to current and former military members and their families.

Full coverage

Company | Monthly rate | ||

|---|---|---|---|

| State Farm | $135 | ||

| Allstate | $166 | ||

| Geico | $226 | ||

| Nationwide | $440 | ||

| Farmers | $319 | ||

| USAA* | $178 | ||

*USAA is only available to current and former military members and their families.

Minimum coverage

Company | Monthly rate | ||

|---|---|---|---|

| Allstate | $67 | ||

| State Farm | $56 | ||

| Geico | $98 | ||

| Nationwide | $216 | ||

| Farmers | $133 | ||

| USAA* | $62 | ||

*USAA is only available to current and former military members and their families.

Best car insurance for new drivers on a family policy

Full coverage car insurance for new drivers costs around half as much if you share a policy with your family.

Rates from Allstate, Geico and State Farm are all cheaper than average. Geico charges the least to add another car and driver to an existing policy at $118 per month, on average.

Although State Farm charges more to add another car and driver, its overall rates are lower than other major companies, making it the cheapest car insurance for young drivers on a family policy. On average, a full coverage policy with parents and a teen driver from State Farm costs $259 per month. That's $320 per month less than average.

Monthly rates for a family policy with a new driver

16-year-old

18-year-old

21-year-old

Company | Parents only | Family w/ 16-year-old |

|---|---|---|

| State Farm | $162 | $339 |

| Geico | $361 | $560 |

| Allstate | $266 | $526 |

| Nationwide | $598 | $1,210 |

| Farmers | $575 | $578 |

| USAA* | $157 | $302 |

Rates are for a first-time driver and two parents sharing a full coverage policy with three cars. *USAA is only available to current and former military members and their families.

16-year-old

Company | Parents only | Family w/ 16-year-old |

|---|---|---|

| State Farm | $162 | $339 |

| Geico | $361 | $560 |

| Allstate | $266 | $526 |

| Nationwide | $598 | $1,210 |

| Farmers | $575 | $578 |

| USAA* | $157 | $302 |

Rates are for a first-time driver and two parents sharing a full coverage policy with three cars. *USAA is only available to current and former military members and their families.

18-year-old

Company | Parents only | Family w/ 18-year-old |

|---|---|---|

| State Farm | $162 | $298 |

| Geico | $361 | $527 |

| Allstate | $266 | $526 |

| Nationwide | $598 | $1,157 |

| Farmers | $575 | $750 |

| USAA* | $157 | $286 |

Rates are for a first-time driver and two parents sharing a full coverage policy with three cars. *USAA is only available to current and former military members and their families.

21-year-old

Company | Parents only | Family w/ 21-year-old |

|---|---|---|

| State Farm | $162 | $165 |

| Allstate | $266 | $190 |

| Geico | $361 | $237 |

| Nationwide | $598 | $274 |

| Farmers | $199 | $461 |

| USAA* | $157 | $209 |

Rates are for a first-time driver and two parents sharing a full coverage policy with three cars. *USAA is only available to current and former military members and their families.

How long can you stay on your parents' insurance?

There is no age limit for sharing a car insurance policy with your parents. As long as you live in the same house, you can share a policy.

Once you move out, you'll need to get your own policy. However, you can stay on your parents' policy if you're still their dependent.

Best car insurance companies for new drivers

State Farm is the best car insurance company for new drivers because it offers reliable customer service and affordable rates.

It's important for first-time drivers to compare insurance quotes to find the cheapest auto rates. But choosing an insurance company with excellent customer service is just as important. A company with good support will pay your claim and fix your car quickly after an accident.

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| State Farm | 859 | A++ | |

| Geico | 843 | A++ | |

| Nationwide | 831 | A+ | |

| Farmers | 818 | A | |

| Allstate | 838 | A+ | |

| USAA* | 890 | A++ |

*USAA is only available to current and former military members and their families.

How much does new-driver insurance cost?

Car insurance for new drivers costs an average of $488 per month for full coverage.

Minimum coverage for new drivers costs around $384 per month. However, car insurance rates differ depending on your age, where you live and other factors, such as your credit score.

How does driving experience affect car insurance rates?

People with little to no driving history tend to pay much more for car insurance.

That's because their lack of driving experience makes them more likely to get into accidents or file an insurance claim. Typically, you'll have to pay higher insurance rates during the first few years of your driving career. However, as you spend more time behind the wheel and gain more experience, you'll likely see your insurance rates fall.

Car insurance rates by years of driving experience

Years licensed | Monthly rate | Decrease from zero experience |

|---|---|---|

| 0 | $132 | 0 |

| 1 | $107 | -19% |

| 2 | $103 | -21% |

| 3 | $100 | -24% |

| 4 | $99 | -25% |

| 5 | $91 | -31% |

Rate decrease is compared to the monthly rate for a driver with no experience.

In Texas, a 30-year-old man with no driving experience can expect to pay $132 per month for minimum coverage. After one year of driving without tickets, his monthly rates go down by $25. After five years of ticket- and accident-free driving, his rates are $41 per month cheaper.

Insurance companies only consider your driving experience within the U.S. If you're an immigrant or foreign driver, you'll typically pay higher rates, even if you have experience driving in another country.

How does age affect car insurance rates?

In general, your car insurance rates will fall as you get older until you reach middle age. Car insurance for teenagers tends to cost more than the same coverage for middle-aged drivers because teen drivers get into more accidents.

However, some people begin driving later in life. If you're a new, but not young, driver, you'll still pay higher rates than other drivers your age. However, you'll pay less than younger drivers with the same experience.

Insurance companies can't use age to set rates if you live in Hawaii or Massachusetts.

New driver car insurance monthly cost by age

Age | Minimum coverage | Full coverage |

|---|---|---|

| 16 | $385 | $810 |

| 17 | $375 | $791 |

| 18 | $378 | $850 |

| 21 | $199 | $449 |

| 25 | $138 | $312 |

Rates are for a single man living in Texas with no driving experience.

Insurance for teens will almost always cost more than insurance for older new drivers. For example, in Texas, a 16-year-old driver pays almost twice what a 25-year-old new driver pays for a full coverage policy. This is despite the fact that they have the same level of driving experience. If you're a first-time driver in your 30s, 40s and 50s, you can expect to pay even less.

How to save on new-driver car insurance

Regardless of your age, you'll pay more for insurance if you don't have much driving experience. However, there are things you can do to lower your rates and lock in discounts.

Get quotes from at least three insurance companies rather than choosing the first policy you find. This will let you compare rates and coverage options so you can choose the policy that best fits your budget.

Low-to-mid-priced vehicles with good safety ratings are usually cheaper to insure than expensive, high-tech cars. If you're looking to buy a new or new-to-you car, get quotes for each car that interests you. You can see how much insurance companies will charge for each car and make your choice based on what fits your budget.

Many insurance companies offer discounts if you pay your entire yearly insurance bill when you buy or renew your policy. The amount of your discount can vary, but often ranges from 5% to 10%, depending on the company.

If you rent or own your home, you could save on your car insurance by bundling your policies. This means buying your car insurance and your home or renters insurance from the same company. Again, the amount you can save will depend on your insurance company.

Your car insurance deductible is what you pay out of your own pocket when you file a claim. Higher deductibles mean you'll pay more for each claim you file and your insurance company will pay less. Most companies pass their savings onto you by lowering your insurance rates.

Be sure to choose a deductible you can afford to pay if you need to file a claim. If the deductible is too high, it could keep you from using your insurance, even when you need it.

Different insurance companies offer different discounts. Before you buy a policy, ask your insurance agent about the discounts they offer. You may be able to lower your rates by taking a defensive driving course or by being a good student if you're still in school.

You may be able to save on your car insurance by joining a family policy. This could mean signing up as a driver under your parents' plan if you still live with them, or signing up under a household plan with your roommates if you all use the same car.

How long are you considered a new driver?

Most insurance companies consider you a new driver if you have less than three years of experience behind the wheel. This means you'll typically pay higher rates for both full and minimum coverage until you have at least three years of driving experience under your belt.

The more experience you have, the lower your rates will be.

Remember, insurance companies consider more experienced drivers to be less likely to get into accidents. As you gain experience, your risk of getting into an accident and needing to file a claim goes down. Your insurance company should offer you lower rates since you're a less risky driver.

Frequently asked questions

How much is insurance for a first-time driver?

Minimum coverage insurance costs $132 per month for first-time drivers, on average. A full coverage policy costs around $322 per month. Young drivers may be able to save money by sharing a policy with parents or older family members.

What is the best insurance for first-time drivers?

New drivers should strongly consider full coverage insurance. Full coverage insurance includes comprehensive and collision coverage, which pays for damage to your car, regardless of fault. That could be worth paying for since first-time drivers usually have more accidents than experienced drivers. State Farm is the best car insurance company for most new drivers because of its cheap full coverage policies.

Does a new driver need insurance?

Every state requires auto insurance or proof of financial responsibility to drive legally. You typically need liability insurance to pay for injuries and damage you cause. You can also buy collision and comprehensive insurance to help pay for damage to your car.

What do you need to get car insurance?

To get car insurance quotes as a new driver, you need to provide your personal info (full name, age, address and driver's license number), vehicle info (make, model, date of purchase and mileage) and your payment info (usually a bank account or credit card).

How much does car insurance cost for a 16-year-old?

A full coverage policy for a 16-year-old new driver costs $602 per month for a stand-alone policy, on average. However, you could save around $286 per month if you share a policy with your parents.

State Farm offers the best car insurance for teens, with an average policy costing just $183 per month for a full coverage policy.

How much do car insurance rates drop when you turn 25?

A 25-year-old driver pays 60% less than an 18-year-old, on average. The biggest rate decrease happens between ages 18 and 21.

Methodology

ValuePenguin experts collected thousands of quotes from ZIP codes across Texas for the largest insurance companies in the state to determine the best rates for new drivers.

For minimum coverage rates, ValuePenguin gathered quotes for a policy with the minimum required limits in Texas. Rates are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX, unless otherwise noted. Full coverage quotes include comprehensive and collision coverage and higher liability limits than the state requirement.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured motorist bodily injury liability: $50,000 per person and $100,000 per accident

- Comprehensive and collision deductible: $500

For the difference in rates after adding a first-time driver to a family policy, quotes are based on a 16-year-old, 18-year-old or 21-year-old male sharing a policy with a married couple who are both 50 years old.

Quadrant Information Services provided insurance rate data for ValuePenguin's analysis. Rates came from public filings and should only be used for comparative purposes. Your quotes will differ.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.