Average Motorcycle Insurance Cost for a 21-Year-Old

The average cost of motorcycle insurance for 21-year-olds is $53 per month, or $634 per year.

Find Cheap Motorcycle Insurance Quotes in Your Area

The cheapest motorcycle insurance company , Dairyland, offers an average rate of $41 per month. Your motorcycle insurance quotes are mainly based on your location, driving history, bike model and coverage.

How much does motorcycle insurance cost for 21-year-olds?

Motorcycle insurance for 21-year-olds costs about $634 per year, or about $53 per month. That's about $9 per month cheaper than motorcycle insurance for a 20-year-old.

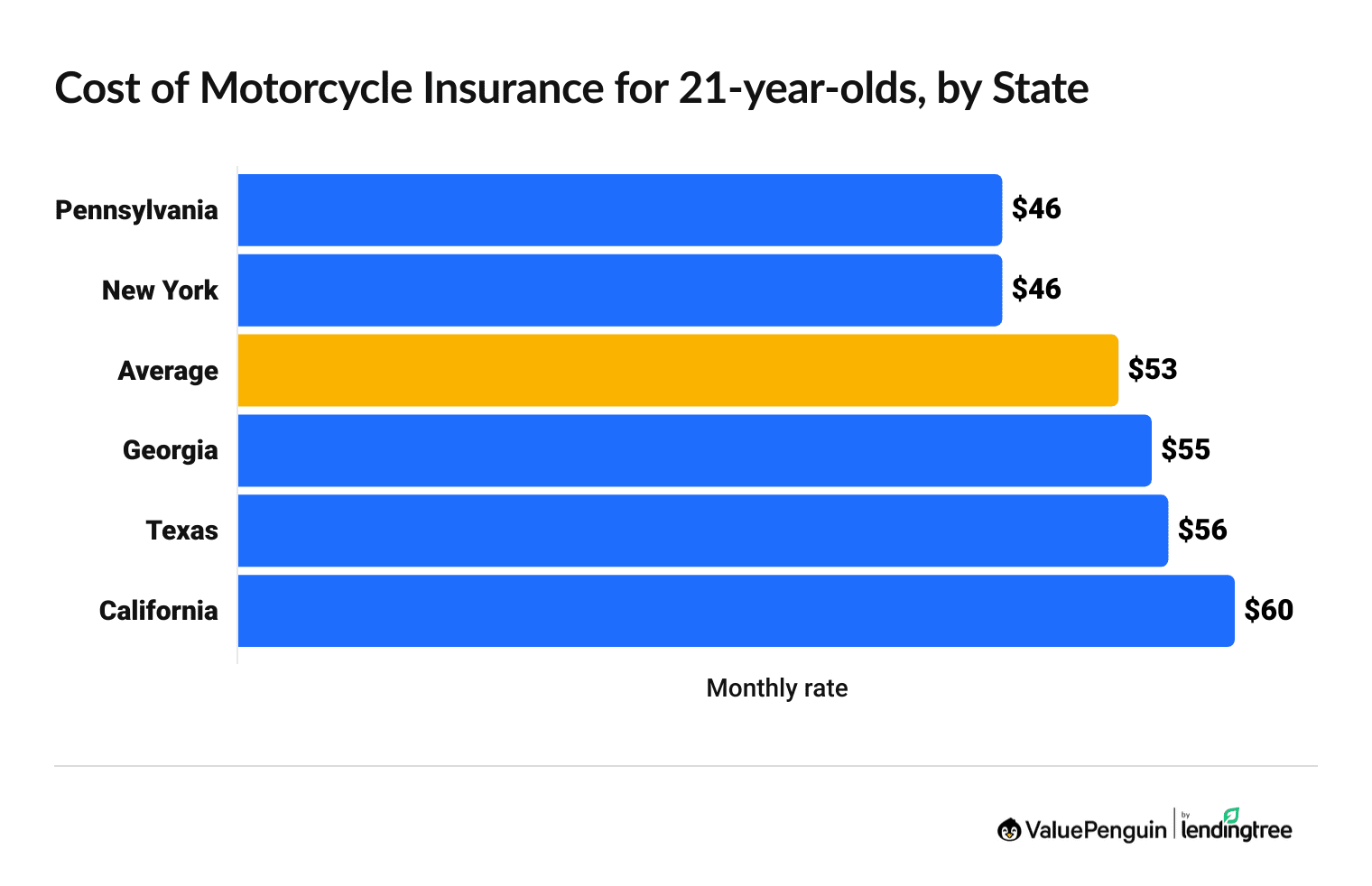

Where you live can have a big impact on how much you pay for motorcycle insurance as a 21-year-old. For example, in Pennsylvania, rates are 24% cheaper than in California.

Cheapest states for motorcycle insurance for 21-year-olds

State | Average monthly rate |

|---|---|

| Pennsylvania | $46 |

| New York | $46 |

| Average | $53 |

| Georgia | $55 |

| Texas | $56 |

| California | $60 |

Gender can impact motorcycle insurance rates for 21-year-olds, but it's not a major factor. It only costs 21-year-old women riders $6 more per year than male motorcycle riders.

Depending on where you live, the cost difference can be higher. California, New York, Pennsylvania and Texas all have the same rates regardless of gender.

Some states don't let insurance companies use gender as a factor to determine rates. Talk with your insurance agent to see if your state is one of them.

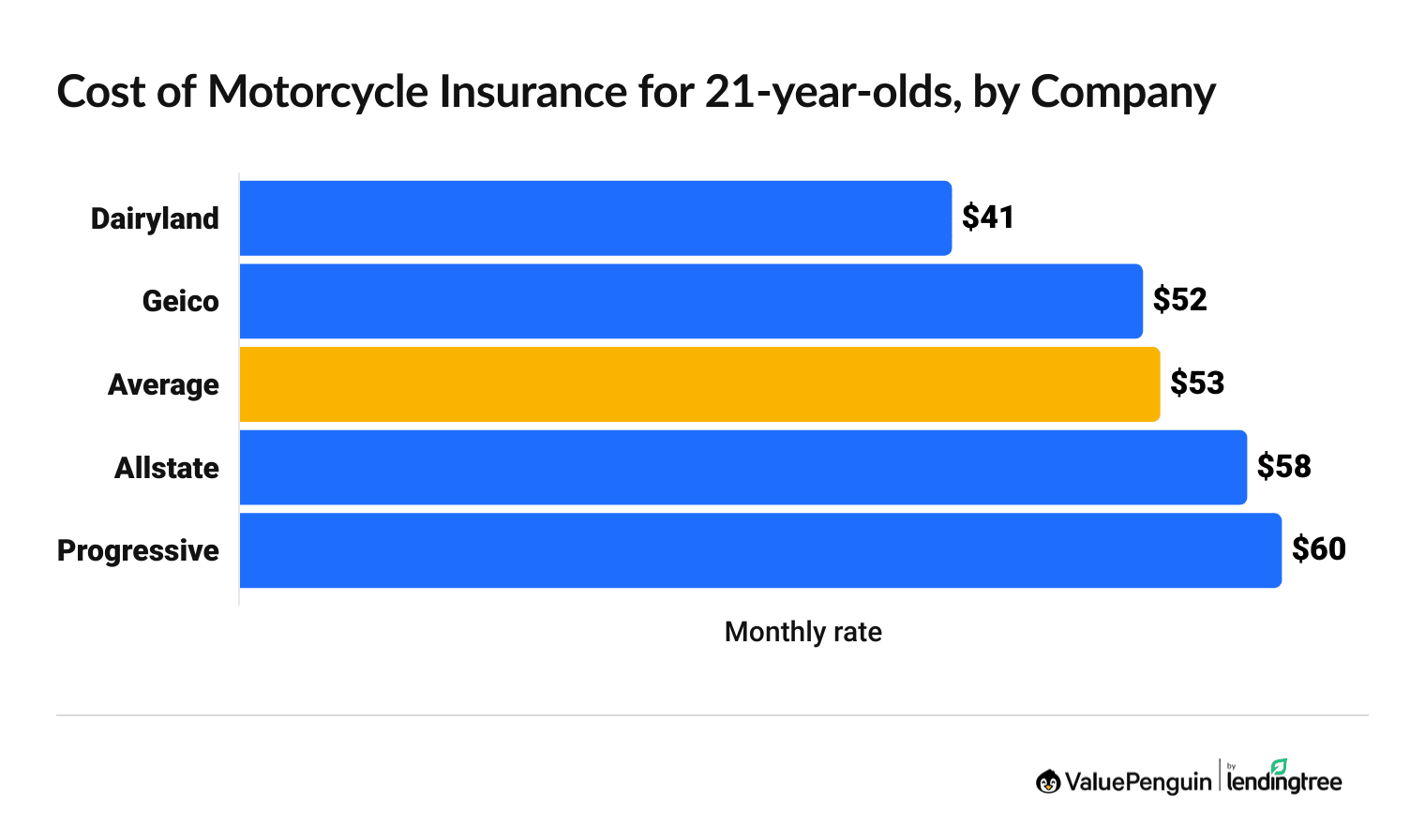

Cheapest motorcycle insurance for 21-year-olds

Dairyland offers the cheapest motorcycle insurance to 21-year-old riders, on average. A full coverage policy from Dairyland costs $41 per month, or $494 per year. That’s 22% cheaper than the average.

Find Cheap Motorcycle Insurance Quotes in Your Area

Cheapest motorcycle insurance companies for 21-year-olds

Company | Average monthly rate | |

|---|---|---|

| Dairyland | $41 | |

| Geico | $52 | |

| Allstate | $58 | |

| Progressive | $60 |

Because rates differ by region, the only way to ensure you get the cheapest rates in your area is to compare quotes from multiple companies.

For example, in Texas, Dairyland's motorcycle quotes are 58% cheaper than the average cost for 21-year-olds in the state. However, in California, Geico offers the cheapest rates for 21-year-olds. A policy costs $135 per year less than the same coverage from Dairyland.

How to save on motorcycle insurance rates as a 21-year-old

You can save money on motorcycle insurance as a 21-year-old by comparing quotes, reviewing your policy and looking for discounts.

There are usually several ways to qualify for a discount with each company, such as:

- Getting your policy information and bills electronically

- Paying your bills automatically or buying a policy in full

- Completing a safety course on your bike

- Renewing a policy or switching from another company

- Bundling with your car, home or renters insurance

What factors impact your motorcycle insurance rates?

The exact price you'll pay for motorcycle insurance when you're 21 will vary based on certain factors, like where you live, the type of bike you have, your experience riding and your riding history.

Location

Your location can impact the rates insurance companies offer. If you live in a safe neighborhood and ride in areas where accidents are less common, your rates may be lower. But if you live in an area with a higher crime rate or ride in an area where accidents happen more often, your rates may be higher.

The type of bike you ride

Bikes with more powerful engines that are capable of higher speeds usually cost more to insure. This is because you're more likely to be in an accident if you ride at high speeds. If you want to lower your rates, consider buying a bike that costs less to insure, like one with a smaller engine or a highway-rated scooter.

The price of your bike can also impact what you pay for insurance. The more expensive the bike is, the more you'll usually pay for coverage. Buying a cheaper bike could help you save on your rates.

Your age

Younger drivers typically pay more for insurance, but once you turn 21, you should start to see your motorcycle insurance rates go down. This is typically because the older you are, the more experience you usually have on the road and the less likely you are to get into an accident.

Your riding experience

Newer riders, regardless of age, often pay higher rates than riders with more experience. If you're 21 and you've been riding since you were 16, you'll likely pay less than a 21-year-old rider who has only had their motorcycle license for a year.

Your history

If you've had several traffic tickets or speeding tickets in the past three years, your rates will usually be higher. If you've filed a claim for an at-fault accident that happened while you were riding or filed a motorcycle insurance claim for any reason, you may pay more for insurance. But if you have a clean record or it's been three years since your last ticket, your rates will typically be lower, even if you're 21.

Why is motorcycle insurance so cheap compared to car insurance?

Insuring a motorcycle costs about one-fourth as much as insuring a car. On average, car insurance costs $248 per month for a 21-year-old driver, on average. That's mainly because bikers are less likely to cause substantial damage to other motorists and their property. Motorcycles are also cheaper to repair than cars, so insurance companies charge less for coverage.

Frequently asked questions

What is the average motorcycle insurance cost for a 21-year-old?

A 21-year-old rider can expect to pay about $53 per month, or $634 per year, for full coverage motorcycle insurance.

Who has the cheapest motorcycle insurance for a 21-year-old?

Dairyland offers the cheapest insurance quotes for 21-year-old bikers. A policy costs $41 per month, or $494 per year, on average.

How much is motorcycle insurance in Texas for a 21-year-old?

The average cost of motorcycle insurance in Texas is $56 per month, or $672 per year, for a 21-year-old rider.

Can a 21-year-old be on their parents' motorcycle insurance?Will my rates go down as I get older?

Your motorcycle insurance rates will usually go down as you get older and have more experience on the road. However, you'll still want to avoid getting tickets and getting into accidents. If you have multiple speeding tickets or make several insurance claims, your rates could go up.

Methodology

We collected motorcycle insurance quotes for 21-year-old male and female riders with a clean driving record who operate a 2020 Harley-Davidson Street 500 and have had a motorcycle license for five years.

Rates are based on the following coverage limits:

Coverage | Limit |

|---|---|

| Bodily injury liability | $25,000 per person/$50,000 per incident |

| Property damage liability | $25,000 per incident |

| Comprehensive and collision | $500 deductible |

Quotes were sourced from California, Georgia, New York, Pennsylvania and Texas.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.