5-Star Medicare Advantage Plans & What Star Ratings Mean

A 5-star Medicare Advantage plan has the highest possible quality rating from Medicare.gov.

Compare Medicare Plans in Your Area

A 5-star rating means the plan has good customer satisfaction and high-quality medical care. If a 5-star plan is offered in your area, you can switch to it at any time by using what is called a 5-star special enrollment period.

For 2026, 5-star plans are offered in 19 states and Puerto Rico. Only around 3% of all Medicare Advantage plans have a 5-star rating in 2026.

What Medicare star ratings mean

A Medicare star rating is a plan’s overall performance and quality score that is calculated across a wide range of factors, including customer satisfaction, access to health care and the rate of receiving preventive care. The amount of information that goes into star ratings makes them one of the most important things to consider when choosing the best Medicare coverage.

Top 5-star Medicare Advantage plans

Medicare Advantage plans with 5 stars are top-tier plans Medicare.gov considers "excellent."

It's not easy for a plan to get a 5-star ranking. For 2026, only about 3% of Medicare Advantage contracts got a 5-star rating. 4- and 4.5-star plans are much more common, accounting for a little more than 1 in 4 plans.

5-star plans have been less common over the last few years, falling from 16% of all plans in 2022 to just around 1% in 2025. However, 2026 has brought an uptick in the number of 5-star contracts, to 3%. In 2025, only seven Medicare Advantage contracts had 5-star ratings. In 2026, there are 18 contracts with 5-star plans.

Most popular 5-star Medicare Advantage companies

Anthem, Devoted Health and UnitedHealthcare are the biggest companies offering 5-star plans in 2026.

Anthem sells 5-star plans in New York, while Devoted Health has 5-star plans in Florida, Iowa, North Carolina and Texas. UnitedHealthcare has 5-star plans in Colorado, Florida, Georgia, Kansas, Maryland, Massachusetts, Michigan, New Jersey, North Carolina, Pennsylvania, South Carolina, Texas and Virginia.

Several smaller companies also have 5-star rated plans, such as Alignment Health Plan, Leon Health Plans, and NHC Advantage.

Keep in mind, these plans may not be available everywhere in the states where they're sold. Since most people will not have access to a 5-star Medicare Advantage plan in 2026, it's a good idea to look for a four-and-a-half-star Medicare Advantage plan from a company like Kaiser Permanente, UnitedHealthcare or Aetna.

These companies have a good reputation for customer service, affordable rates and good coverage. Plus, Aetna and UnitedHealthcare are available in most of the U.S. Kaiser Permanente only sells plans in eight states and Washington, D.C.

Cost of 5-star plans in 2026

For 2026, a 5-star Medicare Advantage plan with prescription drug coverage costs an average of $21 per month. But cheaper 5-star plans are often available, so it's always a good idea to shop around.

Are 5-star plans worth it?

A 5-star Medicare plan is a good choice because its high ratings show the plan has good customer service, satisfied customers, quality management and effective health care across a range of needs, including diabetes, heart disease and preventive care.

Plus, 5-star plans are not necessarily more expensive. The cost of a Medicare Advantage plan is not determined by its quality ratings. Instead, the cost is based on a plan's benefits, the size of the doctor network, add-on benefits and other policy details. This means it’s possible to get a 5-star Medicare Advantage plan that costs $0, a very good deal for a top-performing plan.

Are 5-star Medicare Advantage plans popular?

Medicare Advantage plans with 5 stars are popular in areas where they're available.

About 2% of people had a 5-star Medicare Advantage plan with prescription drug coverage in 2025, and only around 1% of Medicare Advantage contracts in the country had 5 stars. Because there are more 5-star plans for 2026, it's likely more people will choose them.

5-star special enrollment period

If a 5-star plan is available in your location, you can switch to it at any time during the year by using what's called a 5-star special enrollment period (SEP).

This means you can change your Medicare Advantage plan, even if it’s not Medicare open enrollment. By using 5-star special enrollment, you'll have easier access to the better-performing Medicare Advantage plans that are offered in your county.

You can only use a 5-star enrollment period once a year, between Dec. 8 and Nov. 30 of the following year. This timing overlaps the traditional fall open enrollment period, allowing changes at any time except the last week of open enrollment.

Even if a better-quality plan isn't your goal, those who have 5-star plans available can also use this enrollment period to change their medical benefits midyear. For example, if you were enrolled in a 4-star plan and you're unhappy with your coverage, you can change your benefits by switching to a 5-star plan.

This workaround can be useful in situations that happen outside open enrollment, such as if you have a health diagnosis that requires more medical care, or if your plan has disadvantages like high copays. Keep in mind that you can only use a 5-star enrollment period to switch to a 5-star plan.

Where can you get a 5-star plan in 2026?

A 5-star plan must be available in your area for you to be eligible to use the 5-star enrollment period.

In 2026, 5-star plans are available in 19 states and Puerto Rico. Fortunately, these states are some of the most populated in the U.S. Plan availability changes by county, which means you might not have access to a 5-star plan, even if you live in one of the states where they're available.

How Medicare star ratings are calculated

Each Medicare plan's overall star rating is a weighted average of several different data points. This means it's a strong measurement that can help you understand which Medicare plans in your area offer the best coverage.

The government measures Medicare Advantage plans with prescription drug coverage across 45 different categories. For a stand-alone Medicare Part D plan for prescription drugs, 12 measurements are combined into the overall score.

The individual measurements are grouped into categories, each showing something different about the health insurance plan. For example, patient survey questions can show how satisfied customers are with their plan.

Star rating category | What it tells us |

|---|---|

| Patient experience | Customer satisfaction |

| Process measurement for improving health status | How often people use preventive care |

| Access to care and customer service | Customer service |

| Improvement measure | How a plan changes each year |

| Health outcomes | Quality of care and progress toward better health |

| Intermediate health outcomes | Whether health care led to short-term improvements in health |

Medicare Part C star rating calculation

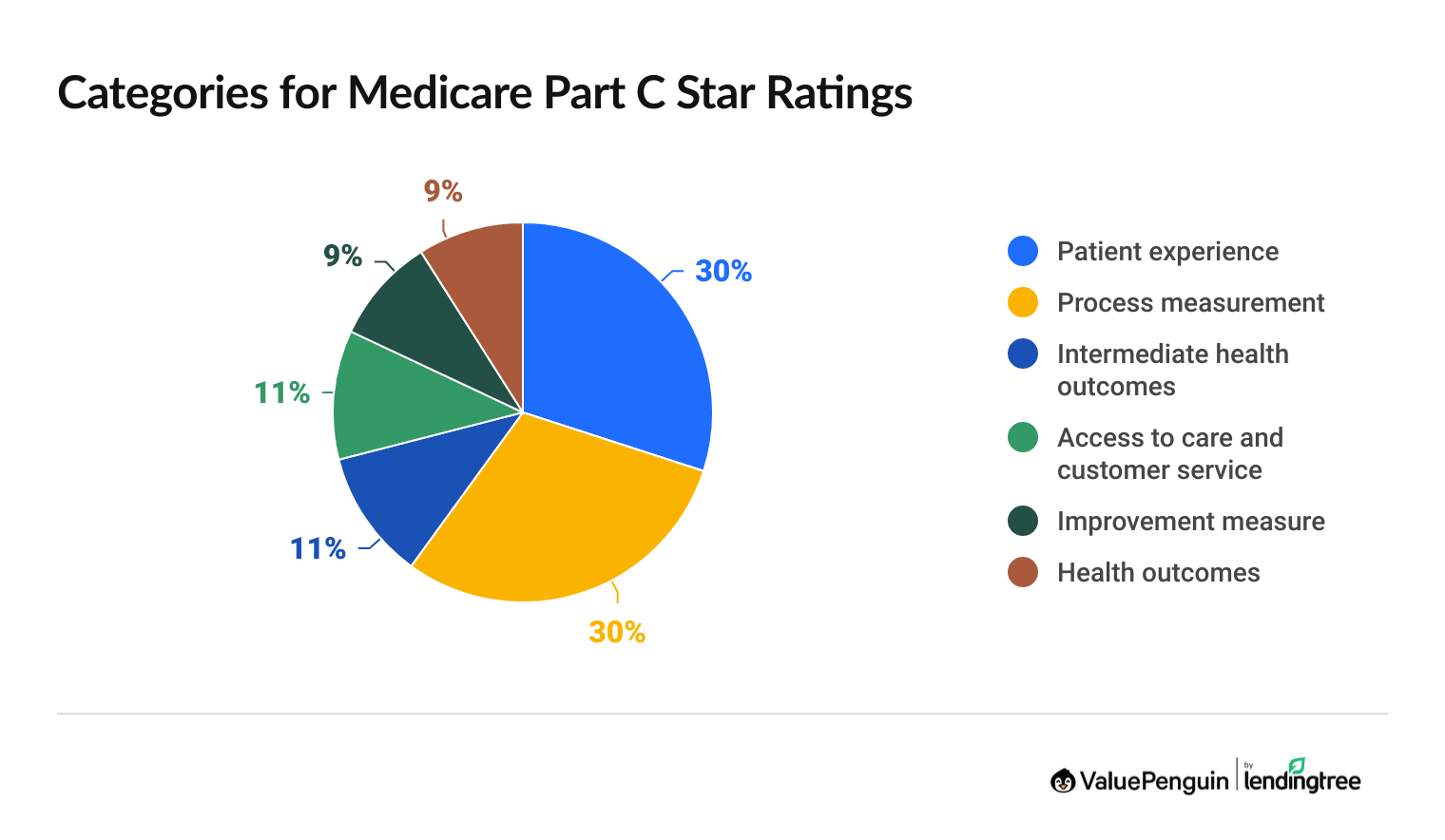

Medicare Part C star ratings combine 33 measurements across five categories. Patient experience and process measurements had the largest impact on the overall score, each accounting for 30% of the Part C star rating.

What's being rated | Description |

|---|---|

| Care coordination | How well the plan coordinates members’ care, including following up after tests and if doctors had accurate patient records |

| Complaints about the plan | Percentage of members filing complaints with Medicare about the health plan |

| Customer service | How easy it is for members to get info and help from the plan when needed |

| Getting appointments and care quickly | How quickly the member was able to get appointments and health care |

| Getting needed care | Ease of getting needed care and seeing specialists |

| Members choosing to leave the plan | Percentage of plan members who chose to leave the plan |

| Rating of health care quality | Member rating of the quality of the health care they got |

| Rating of health plan | Members' overall view of their health plan |

What's being rated | Description |

|---|---|

| Breast cancer screening | Percentage of female plan members ages 50 to 74 who had a mammogram during the past two years |

| Care for older adults: medication review | Percentage of plan members whose doctor or pharmacist reviewed a list of everything they take at least once a year (includes prescription and nonprescription drugs, vitamins, herbal remedies and other supplements) |

| Care for older adults: pain assessment | Percentage of plan members who had a pain screening at least once during the year |

| Colorectal cancer screening | Percentage of plan members ages 50 to 75 who had appropriate screening for colon cancer |

| Diabetes care: eye exam | Percentage of plan members with diabetes who had an eye exam to check for damage from diabetes during the year |

| Diabetes care: kidney disease monitoring | Percentage of plan members with diabetes who had a kidney function test during the year |

| Emergency room follow-up for people with chronic conditions | Percentage of plan members with two or more chronic conditions who got follow-up medical care within seven days of an emergency room visit |

| Improving bladder control | Percentage of plan members with a urine leakage problem in the past six months who discussed treatment options with a doctor |

| Medication review after leaving the hospital | Percentage of plan members whose medication records were updated within 30 days after leaving the hospital, a process that compares new prescriptions to existing prescriptions to help prevent errors |

| Monitoring physical activity | Percentage of senior plan members whose doctor asked them to start, increase or continue their physical activity |

| Osteoporosis management in women who had a fracture | The percentage of female enrollees aged 67 to 85 who broke a bone and who had either a bone mineral density (BMD) test or prescription for a drug to treat osteoporosis in the six months after the fracture |

| Reducing the risk of falling | The percentage of Medicare members ages 65 and older who had a fall or had problems with balance or walking in the past 12 months and who got a recommendation for how to prevent falls or treat balance problems |

What's being measured | Description |

|---|---|

| Controlling blood pressure | Percentage of plan members with high blood pressure who are able to maintain a healthy blood pressure through medical treatment |

| Diabetes care: blood sugar controlled | Percentage of plan members with diabetes who had an A1C lab test during the year that showed their average blood sugar is under control |

What's being measured | Description |

|---|---|

| Call center: foreign language interpreter and TTY | Percentage of time that TTY services and foreign language interpretation were available when needed by people who called the health plan’s prospective enrollee customer service phone line |

| Plan makes timely decisions about appeals | Percentage of coverage appeals that are processed in a timely way as a percentage of all the plan's appeals |

| Reviewing appeals decisions | How often an independent reviewer upheld a plan's decision to deny coverage as a percentage of all appeals |

What's being measured | Description |

|---|---|

| Health plan quality improvement | How much the health plan’s performance improved or declined from one year to the next, based on star ratings |

What's being measured | Description |

|---|---|

| Improving or maintaining mental health | Percentage of plan members who maintained or improved their mental health over two years |

| Improving or maintaining physical health | Percentage of plan members who maintained or improved their physical health over two years |

| Plan all-cause readmissions | Percentage of plan members ages 18 or older who were discharged from the hospital but were readmitted within 30 days, either for the same or a different reason |

Medicare Part D star rating calculation

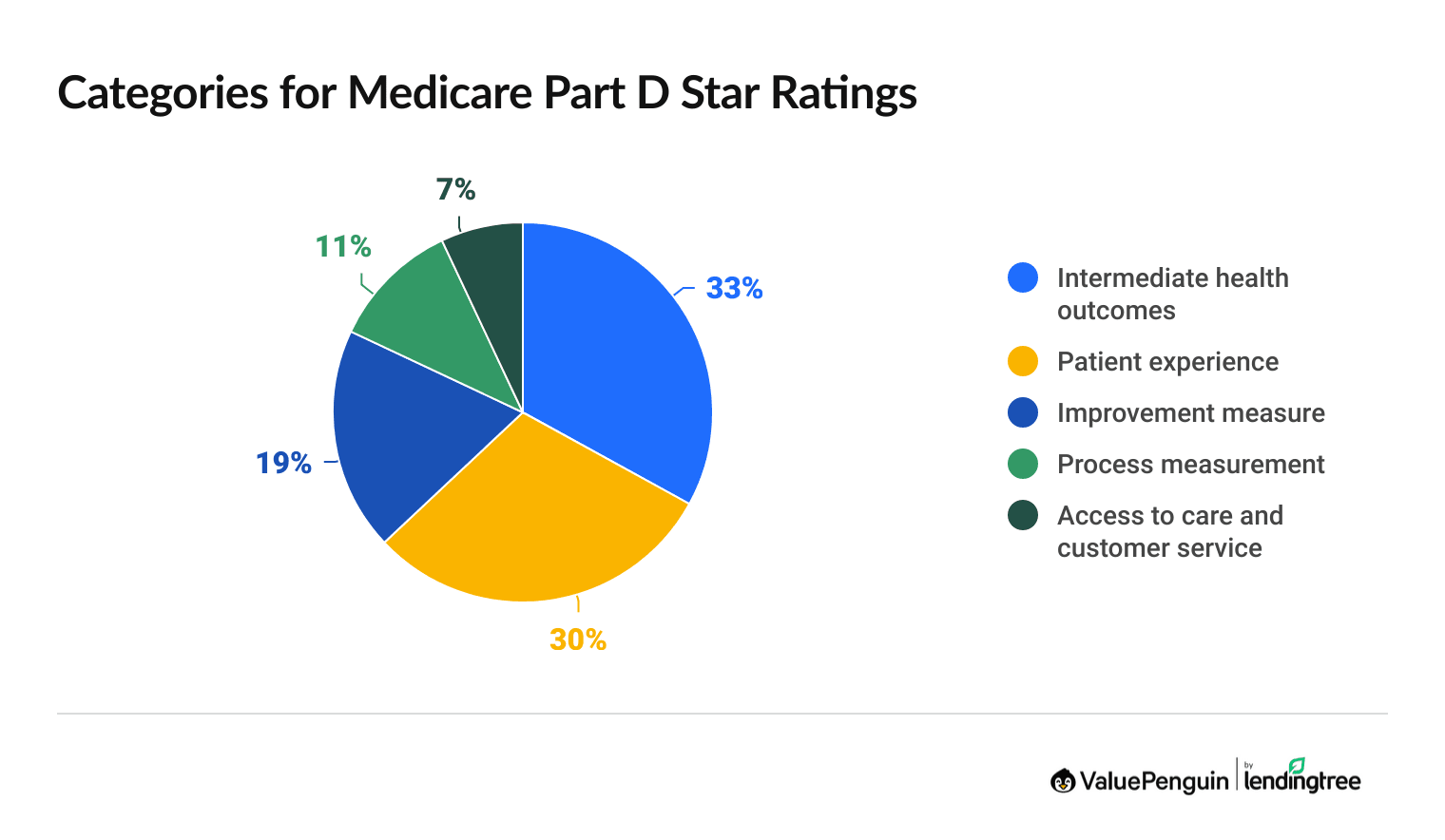

Medicare Part D star ratings include 12 measurements across the five categories, and ratings apply to both stand-alone Part D plans and the prescription drug benefits included with most Medicare Advantage plans.

The intermediate outcomes category has the largest impact on overall Medicare Part D star ratings, accounting for 33% of the overall score. This category looks at how often most people fill their prescriptions. That shows if the plan's benefits for common medications are both affordable and accessible.

What's being measured | Description |

|---|---|

| Medication adherence for cholesterol (statins) | Percentage of plan members with a prescription for a cholesterol medication who fill their prescription often enough to cover 80% or more of the time they are supposed to be taking the medication |

| Medication adherence for diabetes medications | Percentage of plan members with a prescription for diabetes medication who fill their prescription often enough to cover 80% or more of the time they are supposed to be taking the medication |

| Medication adherence for hypertension (RAS antagonists) | Percentage of plan members with a prescription for a blood pressure medication who fill their prescription often enough to cover 80% or more of the time they are supposed to be taking the medication |

What's being measured | Description |

|---|---|

| Complaints about the drug plan | Percentage of members filing complaints with Medicare about the health plan |

| Getting needed prescription drugs | Ease of getting medicines their doctor prescribed, including using the plan, local pharmacies and prescriptions by mail (from survey) |

| Members choosing to leave the plan | Percentage of plan members who chose to leave the plan |

| Rating of drug plan | Member rating of the quality of the prescription drug plan (from survey ratings) |

What's being measured | Description |

|---|---|

| Drug plan quality improvement | How much the drug plan’s performance improved or declined from one year to the next, based on star ratings |

What's being measured | Description |

|---|---|

| MPF price accuracy | Accuracy of pricing between what members actually pay for their drugs versus the plan's drug prices on the Medicare Plan Finder |

| MTM program completion rate for CMR | Members who had a pharmacist or other health professional help them understand and manage their medications |

| Statin use in persons with diabetes (SUPD) | Percentage of plan members with diabetes who take the most effective cholesterol-lowering drugs to lower their risk of developing heart disease |

What's being measured | Description |

|---|---|

| Call center: foreign language interpreter and TTY | Percentage of time interpreter and TTY was available for those who needed it, out of the total number of attempted contacts with these services |

How to use star ratings to choose a plan

Consider the three following factors when choosing a Medicare Advantage plan.

The best plans balance all three of these factors. It's a good idea to start by looking at the top-rated plans in your area, including 5-star plans and 4.5-star plans. Then compare the costs and medical benefits offered by these options.

Enrolling in the highest-star plan in your area usually makes sense because you'll likely face fewer hassles when you get care. However, there are times when it may be worth it to choose a lower-star plan.

For example, you might consider a 4- or 4.5-star plan over a 5-star plan if:

- You want to see a specific doctor that's not in the higher-rated plan's network

- The plan's benefits better match your medical needs

- The plan's list of covered medications better matches your current prescriptions

When do Medicare star ratings come out?

Medicare star ratings come out each October before fall open enrollment. This usually happens a week before Medicare open enrollment starts on Oct. 15.

Frequently asked questions

What are Medicare star ratings based on?

Medicare star ratings are based on 45 different coverage categories, such as member satisfaction, medical care and how often customers fill their prescriptions. You can use these ratings to help find the best Medicare Advantage plan in your area.

What does a Medicare.gov 5-star rating mean?

A 5-star Medicare plan has earned the best possible rating for quality and performance. If a 5-star plan is available in your area, you can switch to it at any time using a 5-star special enrollment period.

What is the highest rating for a Medicare Advantage plan?

A 5-star Medicare Advantage plan has the highest possible rating. Plans are ranked on a scale of 1 star to 5 stars. Only about 3% of Medicare contracts have a 5-star rating for 2026.

Can you get a $0 Medicare Advantage plan with 5 stars?

Yes, you can get a $0 Medicare Advantage plan with a 5-star rating, but it depends on where you live. Keep in mind that cheaper plans tend to have less coverage than more expensive plans. For example, a 5-star plan that costs $0 would be high quality, but you may also have to pay more when you go to the hospital.

Why are star ratings important when choosing a Medicare plan?

Medicare star ratings tell you about a plan's quality and performance across many different categories, such as customer satisfaction and health outcomes.

Methodology

Data and analysis are based on Centers for Medicare & Medicaid Services (CMS) public use files, fact sheets and technical notes. Medicare Advantage analysis only includes plans that include prescription drug coverage and excludes employer-sponsored plans, special needs plans, PACE plans, sanctioned plans and health care prepayment plans (HCPPs).

Insurance Writer

Cate Deventer is a ValuePenguin writer who specializes in health insurance, Medicare, auto and home insurance. She's been a licensed insurance agent since 2011.

She started her insurance career working as a customer service agent for State Farm. She later moved to an independent agency, where she worked with several insurance companies and hundreds of clients. She quoted policies, filed claims and answered insurance questions. In 2021, she pivoted her career and began writing about insurance for Bankrate. She moved to ValuePenguin in 2023 and began writing about health insurance and Medicare.

Cate has a passion for helping readers choose insurance to fit their needs. She enjoys knowing that her research and knowledge help people choose insurance products that make a positive difference in their lives.

How insurance helped Cate

Cate used her health insurance knowledge to navigate a surgery in 2023. Understanding how her policy worked let her focus on recovery instead of worrying about bills.

Expertise

- Health insurance

- Medicare & Medicaid

- Auto insurance

- Home insurance

- Life insurance

Credentials

- Licensed Life, Accident & Health Insurance Agent

- Licensed Property & Casualty Insurance Agent

Referenced by

- CBS

- NBC

- Wall Street Journal

Education

- BA, Theatre, Purdue University

- BA, English, Indiana University

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.