How Much Does Rivian Insurance Cost? Rates and Discounts

Insurance on a Rivian is more expensive than average, at around $273 a month for full coverage.

Electric vehicle manufacturer Rivian offers its own auto insurance, in a way. Rivian Insurance acts as a middleman and connects you to one of three larger insurance companies: Progressive, Nationwide or Cincinnati Insurance.

The benefit of having coverage through the manufacturer is that you have a direct link to parts and labor if you need repairs covered by insurance. This could mean lower rates and a smoother experience.

On this page

How does Rivian Insurance work?

Rivian Insurance works the same way as most car insurance. You select the coverage you want, bundle other policies, get a quote and file a claim like normal.

Your coverage will come from Progressive, Nationwide or Cincinnati Insurance, depending on where you live.

If you are in an accident, you’ll mainly work with the company backing your policy, not Rivian. But the connection you have to the carmaker means you have better access when it comes to repairs.

You can also get coverage for your Rivian directly from standard insurance companies.

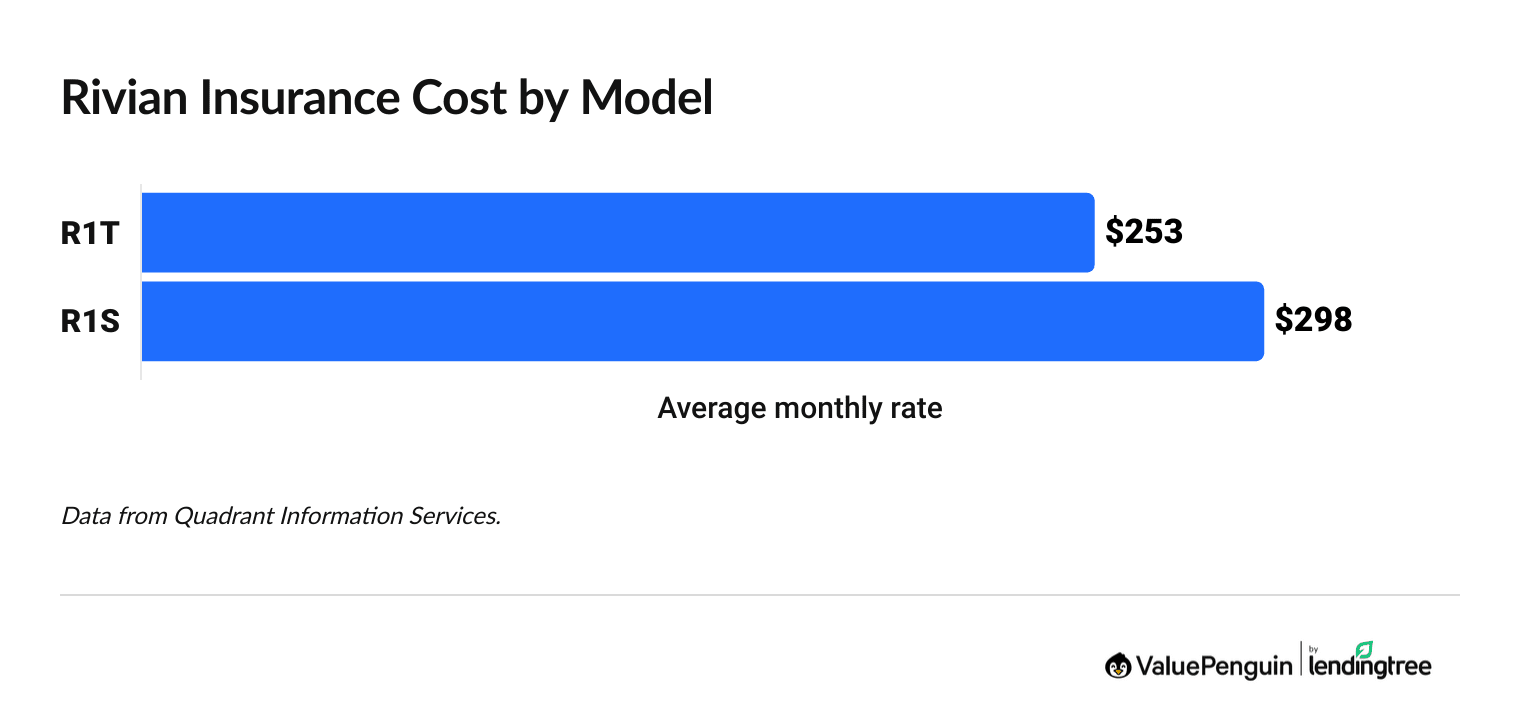

Rivian insurance cost by model

On average, you’ll pay $253 per month for the Rivian truck and $297 per month for the Rivian SUV.

Typical full coverage car insurance costs only $175, but electric vehicles are more expensive to repair. The average full coverage Rivian insurance policy is 56% more than the national average.

As a young car company, Rivian offers only two models, the R1T pickup and the R1S SUV. But you can mix and match battery size, trims and the number of electric motors.

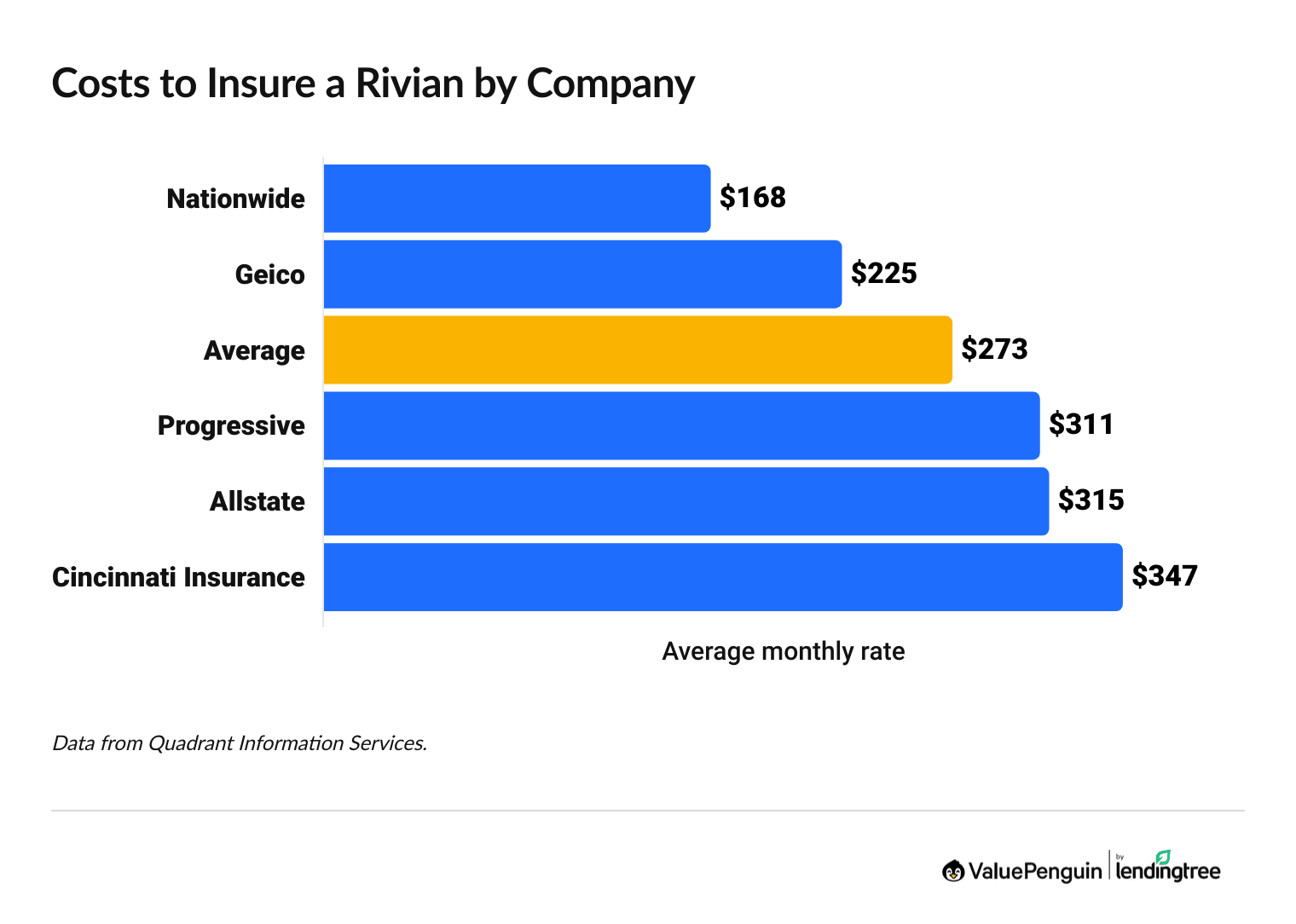

Rivian insurance rates by company

Nationwide tends to have the cheapest car insurance for Rivian owners — $168 per month for full coverage.

That's 38% cheaper than the average rate of $273 per month on a Rivian. Geico also offers monthly rates that are lower than average, at $225 a month.

The most expensive coverage is from Cincinnati Insurance, at around $347 monthly.

Getting quotes from multiple companies is the best way to make sure you're not overpaying.

Find Cheap Auto Insurance Quotes in Your Area

Cheapest companies for Rivian insurance

Company | Average monthly rate | |

|---|---|---|

| Nationwide | $168 | |

| Geico | $225 | |

| Progressive | $311 | |

| Allstate | $315 | |

| Cincinnati Insurance | $347 |

Average monthly rates for full coverage. Data is from Quadrant Information Services.

Cost to insure a Rivian R1T truck

Based on our analysis, the cheapest Rivian to insure is the 2025 R1T Ascend trim at $234 a month.

But the Rivian trucks that are the most expensive to insure don't cost too much more. The 2023 R1T Launch Edition costs only $24 more per month and the 2024 R1T Adventure with Quad Motor costs $29 more per month.

Model | Average monthly rate |

|---|---|

| 2025 R1T Ascend | $234 |

| 2025 R1T Adventure | $246 |

| 2024 R1T Adventure | $257 |

| 2024 R1T Adventure with Quad Motor | $261 |

| 2023 R1T Adventure | $263 |

| 2023 R1T Adventure with Quad Motor | $254 |

| 2023 R1T Launch Edition | $258 |

Average monthly rates for full coverage on the R1T Rivian truck. Data is from Quadrant Information Services.

Cost to insure a Rivian R1S SUV

The 2025 R1S Ascend is the most expensive to insure, based on our findings, at $300 per month.

But there is very little difference in average monthly insurance prices for the Rivian SUV. The cheapest is only $5 less: Insuring the 2024 R1S Adventure trim costs $295, on average.

Model | Average monthly rate |

|---|---|

| 2025 R1S Ascend | $300 |

| 2025 R1S Adventure | $297 |

| 2024 R1S Adventure | $295 |

| 2024 R1S Adventure with Quad Motor | $295 |

| 2023 R1S Adventure | $297 |

| 2023 R1S Launch Edition | $299 |

Average monthly rates for full coverage on the R1S Rivian SUV. Data is from Quadrant Information Services.

Rivian insurance discounts

Your discount options depend on which insurance company provides your coverage.

Progressive, Nationwide and Cincinnati Insurance all offer:

- Multicar discount: Save more with each car you insure.

- Good student discount: Student drivers with good grades can earn savings.

- Bundling discount: Have different types of coverage with one company. You can bundle coverage for your home, apartment, RV, boat, ATV and snowmobile with Rivian Insurance.

- Usage-based discount: Let the company track you driving well.

Find Cheap Auto Insurance Quotes in Your Area

Rivian Driver Assist Discount

The more you use active safety features, the larger your discount may be.

You can earn a discounted rate if you let the insurance company track you and you drive well, using the Driver+ features:

-

Highway Assist: Automatic steering, braking and acceleration

- Adaptive Cruise Control: Automatically adjust your speed to keep a safe distance

- Lane Change Assist: Assisted highway lane changes

- Lane Keep Assist: Helps steer you back into your lane

When you allow an insurance company to track your driving, it’s called usage-based insurance. Other programs include State Farm Drive Safe & Save and Liberty Mutual RightTrack.

Usage-based insurance can knock down your rate by 30%, depending on your driving, where you live and your insurance company.

Frequently asked questions

Are Rivians expensive to insure?

Yes, Rivians are expensive to insure because they're expensive to repair and replace. Full coverage insurance on a Rivian costs $273 per month, on average.

Who does Rivian use for insurance?

Nationwide, Progressive and Cincinnati Insurance underwrite Rivian Insurance policies. That means you'll work with one of those companies if you're in an accident.

Why is EV insurance expensive?

EVs have large batteries and use a lot of newer technology. So they have expensive parts, and not many car technicians can fix them. This makes it harder to find repair shops, and they often cost more.

Sources and methodology

Information about the coverage Rivian offers came from the company's website, Nationwide, Cincinnati Insurance and Progressive.

Insurance rate data is from Quadrant Information Services. For the national average car insurance price, quotes were pulled from 39 of the largest insurance companies across all available ZIP codes in all 50 states and Washington, D.C. Quotes are for a 30-year-old man with a 2015 Honda Civic EX and good credit.

Full coverage policies include policies that were set at:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured or underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum, when required by state

This full coverage definition was also used for Rivian insurance quotes.

Rivian quotes were pulled from the largest insurance companies that operate in Ohio, plus the companies that underwrite for Rivian Insurance. Rates were pulled for all Ohio ZIP codes and averaged.

Quotes on Rivian vehicles were for full coverage on the following models:

- 2023 R1S Launch Edition

- 2023 R1T Launch Edition

- 2023 R1S Adventure

- 2023 R1T Adventure with Quad Motor

- 2023 R1T Adventure

- 2024 R1S Adventure

- 2024 R1T Adventure

- 2024 R1S Adventure with Quad Motor

- 2024 R1T Adventure with Quad Motor

- 2025 R1S Adventure

- 2025 R1S Ascend

- 2025 R1T Adventure

- 2025 R1T Ascend

These rates were publicly sourced from insurer filings and should be used for comparative purposes only.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia