Who Has the Cheapest Car Insurance in Utah? (2026)

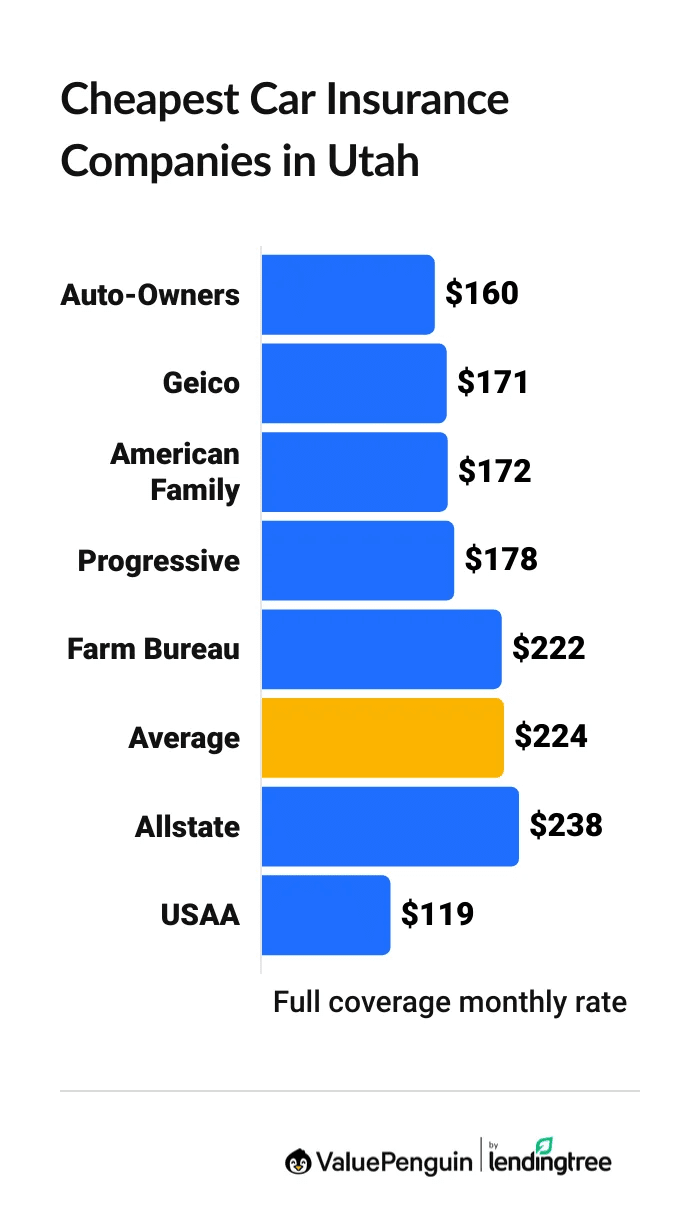

Auto-Owners has the cheapest car insurance in Utah, at $160 per month for full coverage. That's $64 per month less than the state average.

Find Cheap Auto Insurance Quotes in Utah

Best cheap car insurance in Utah

- Cheapest full coverage: Auto-Owners, $160/mo

- Cheapest minimum liability: Auto-Owners, $67/mo

- Cheapest for young drivers: Geico, $219/mo

- Cheapest after a ticket: Auto-Owners, $160/mo

- Cheapest after an accident: American Family, $251/mo

- Cheapest for teens after a ticket: Farm Bureau, $264/mo

- Cheapest after a DUI: Progressive, $238/mo

- Cheapest for poor credit: American Family, $267/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Auto-Owners has cheap rates and good customer service scores in Utah. However, it doesn't offer online quotes, so you'll have to contact a local agent to compare rates.

American Family is good for Utah drivers looking to quickly compare quotes online. It has reliable customer service, although it's typically more expensive than Auto-Owners.

Cheapest car insurance in Utah: Auto-Owners and USAA

Auto-Owners and USAA have the cheapest full coverage car insurance in Utah.

Find Cheap Auto Insurance Quotes in Utah

Auto-Owners is the best choice for most Utah drivers, at $160 per month for full coverage. Although it's slightly less convenient because you have to call an agent for a quote, it has cheap rates and good customer service.

Utah drivers with military connections can find the cheapest quotes at USAA, at $119 per month. However, only military members, veterans and their families can buy insurance from USAA.

Cheapest full coverage auto insurance rates in Utah

Company | Monthly rate | |

|---|---|---|

| Auto-Owners | $160 | |

| Geico | $171 | |

| American Family | $172 | |

| Progressive | $178 | |

| Farm Bureau | $222 |

*USAA is only available to current and former military members and their families.

Data-powered research on Utah car insurance

Data-powered research on UT car insurance |

|---|

Cheapest liability-only car insurance in Utah: Auto-Owners

Auto-Owners has the cheapest minimum liability car insurance in Utah, at $67 per month.

That's $35 per month cheaper than the Utah average, which is $102 per month. Its rates are cheap, and its service ratings are good but not the best. The top-rated companies in Utah, State Farm and Farmers, tend to have the most expensive rates.

However, Auto-Owners doesn’t offer online quotes. Geico has the cheapest rates for Utah drivers looking to quickly compare quotes and buy a policy online, at $81 per month for minimum liability coverage.

Best cheap auto insurance in Utah

Company | Monthly rate | |

|---|---|---|

| Auto-Owners | Auto-Owners | $67 |

| Geico | Geico | $81 |

| Farm Bureau | Farm Bureau | $84 |

| Progressive | Progressive | $85 |

| American Family | American Family | $90 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Utah

Drivers with military ties should also get car insurance quotes from USAA. It has the cheapest liability-only quotes in Utah, at $49 per month. But, it's available only to military members, veterans and their families.

Cheapest Utah auto insurance for teens: Geico

Geico has the cheapest car insurance in Utah for young drivers.

Minimum liability coverage from Geico costs around $219 per month for an 18-year-old driver. That's $146 per month cheaper than the Utah average for teens.

Geico also has the cheapest full coverage rates for Utah teens. At $441 per month, full coverage from Geico is $336 less per month than the state average.

Affordable car insurance in Utah for teens

Company | Liability only | Full coverage |

|---|---|---|

| Geico | $219 | $441 |

| Farm Bureau | $232 | $584 |

| Auto-Owners | $277 | $563 |

| Progressive | $298 | $742 |

| Allstate | $403 | $860 |

*USAA is only available to current and former military members and their families.

In Utah, 18-year-old drivers pay about two and a half times more for car insurance than 30-year-olds. That's because young drivers have less experience, so they're more likely to be in car accidents.

After comparing rates from multiple companies, you might still find that your quotes aren't affordable. Young drivers in Utah can save money on car insurance by:

Sharing a policy with their parents. A family policy is almost always less expensive than buying two separate policies, and you may get a multicar discount.

Asking about discounts. You could save with discounts for getting good grades, taking safe driving classes and having a safe car.

Getting rid of unnecessary coverage. If you have an older car that's not worth much, you might not need collision and comprehensive coverage. And you may not need roadside assistance if you have a car warranty or another roadside package, like AAA.

Cheapest auto insurance in Utah after a ticket: Auto-Owners

Auto-Owners has the cheapest car insurance in Utah after a speeding ticket. Full coverage from Auto-Owners costs $160 per month after one ticket. That's $112 per month less than the Utah average. It's also $45 per month less expensive than the second-cheapest company, American Family.

Best car insurance rates in Utah after a speeding ticket

Company | Monthly rate |

|---|---|

| Auto-Owners | $160 |

| American Family | $205 |

| Geico | $234 |

| Progressive | $248 |

| Farm Bureau | $251 |

*USAA is only available to current and former military members and their families.

In Utah, a single speeding ticket will raise your rates by around 21%. That's an average increase of $48 per month for a full coverage policy.

Cheap auto insurance in UT after an accident: American Family

American Family is the cheapest insurance company in Utah after an at-fault accident. At $251 per month, full coverage from American Family is $81 per month cheaper than the state average.

Utah drivers should also consider Auto-Owners after a crash. Although it is $20 more expensive per month than American Family, it has better customer service reviews.

Affordable Utah auto insurance quotes after an accident

Company | Monthly rate |

|---|---|

| American Family | $251 |

| Auto-Owners | $271 |

| Progressive | $285 |

| Geico | $329 |

| Farm Bureau | $343 |

*USAA is only available to current and former military members and their families.

The average cost of car insurance in Utah goes up by 48% after an accident.

Don't switch car insurance companies right after an accident. Your rates won't go up until your policy renews. Yet, any new quotes will factor in your crash, so they'll probably be more expensive than your current rate.

Instead, wait until your insurance company sends your renewal offer. This is typically a few weeks to a month before your policy expires. Then, shop around for multiple quotes to find the best rates for you.

Best car insurance in UT for teens with a ticket or accident: Farm Bureau

Farm Bureau has the most affordable car insurance in Utah for young drivers with a speeding ticket. Progressive has the cheapest rates for teens after an accident.

After a ticket, minimum coverage from Farm Bureau costs $264 per month. That's close to 40% less than the Utah state average.

Teens with an accident on their records pay around $351 per month for a minimum liability policy from Progressive. That's $138 per month less than the state average.

Cheapest auto insurance in Utah for teens after a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| Farm Bureau | $264 | $361 |

| Auto-Owners | $277 | $449 |

| Geico | $281 | $398 |

| Progressive | $336 | $351 |

| Allstate | $462 | $577 |

*USAA is only available to current and former military members and their families.

Teen drivers in Utah see their rates go up by an average of 16% after a speeding ticket and 34% after an at-fault accident.

Cheapest Utah car insurance quotes after a DUI: Progressive

Progressive has Utah's cheapest auto insurance quotes after a DUI, at $238 per month for full coverage. That's 38% less than the state average.

Cheapest Utah car insurance with a DUI

Company | Monthly rate |

|---|---|

| Progressive | $238 |

| Farm Bureau | $251 |

| Geico | $303 |

| Allstate | $324 |

| American Family | $331 |

*USAA is only available to current and former military members and their families.

A DUI in Utah can increase your car insurance rates by 71%, or an average of $160 per month for a full coverage policy. It can be helpful to compare quotes from multiple companies after a change in your driving record to make sure you get the best rate.

Keep in mind that if you have accidents, tickets or a DUI on your driving record, you'll be viewed as a riskier driver.

That might make it more likely you'll be dropped by a new company if you get another ticket or cause another accident. Sometimes it's best to stay with a company if you have a history with it. If you're not sure of the best thing to do, talk with a licensed agent.

Cheap insurance in Utah for drivers with poor credit: American Family

American Family has the best quotes for Utah drivers with poor credit. At $267 per month, full coverage from American Family is $152 per month less than the Utah state average. It's also $19 per month less than the second-cheapest option, Progressive.

Best Utah car insurance companies for poor credit

Company | Monthly rate |

|---|---|

| American Family | $267 |

| Progressive | $286 |

| Geico | $312 |

| Farm Bureau | $418 |

| Allstate | $423 |

*USAA is only available to current and former military members and their families.

Drivers with poor credit pay 87% more for auto insurance in Utah than drivers with good credit.

That's because insurance companies believe drivers with lower credit scores tend to file more insurance claims. So even though credit ratings don't affect your ability to drive safely, you'll usually pay more for coverage.

Best car insurance in Utah: USAA

USAA is the best company for Utah drivers, based on its excellent customer service and cheap quotes.

However, USAA is available only to military members, veterans and some of their family members.

Auto-Owners and American Family are some of the best Utah car insurance companies if you don't qualify for USAA. Both companies offer reliable customer service and affordable car insurance in Utah. If you can afford higher rates, State Farm has the best service ratings in Utah after USAA.

Best Utah car insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| Farm Bureau | 645 | A | |

| Auto-Owners | 638 | A+ | |

| American Family | 640 | A |

Average car insurance rates in Utah by city

Moab, a rural town near Arches National Park, has the cheapest car insurance quotes in Utah.

Full coverage car insurance in Moab costs an average of $207 per month.

Kearns, a suburb of Salt Lake City, has the most expensive rates in the state, at $297 per month. That's partially because the Salt Lake area has much higher auto theft rates than other parts of Utah.

Utah car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Alpine | $271 | 21% |

| Altamont | $236 | 6% |

| Alton | $223 | 0% |

| Altonah | $239 | 7% |

| American Fork | $261 | 17% |

Average car insurance prices in Utah differ by about $89 per month for full coverage, depending on where you live. That's because factors like road quality, car theft rates and traffic congestion can change your insurance rates.

What is the minimum car insurance in Utah?

Utah drivers need at least 30/65/25 of liability insurance, as of Jan. 1, 2025.

Your policy must also have personal injury protection (PIP) insurance, sometimes called "no-fault insurance." This helps pay for your own injuries after an accident, even if it wasn't your fault.

There are serious penalties if you drive without insurance in Utah, even if it's because you accidentally forget to pay your bill and your coverage lapses.

If you don't have insurance and are pulled over or cause an accident, your vehicle registration and driver's license could be suspended. You'll also have to pay a fine of at least $400 for your first offense and $1,000 for your second offense.

To get your car registration reinstated, you'll have to pay an additional $100 reinstatement fee and show proof of current insurance coverage.

Minimum car insurance requirement in Utah

- Bodily injury liability: $30,000 per person and $65,000 per accident

- Property damage liability: $25,000 per accident

- Personal injury protection: $3,000 per accident

In Utah, personal injury protection coverage contains four parts:

- A $3,000 limit covering necessary medical expenses and rehab after an accident. If someone covered under the policy dies in an accident, the $3,000 of coverage will be given to their heirs.

- A $1,500 funeral allowance if your passenger dies as a result of the accident.

- Up to 85% of lost income due to injuries from an accident, up to $250 per week.

- A special allowance up to $20 per day for services if you can't perform certain tasks due to injuries.

What's the best car insurance to get in Utah?

Most drivers in Utah should have full coverage car insurance.

Full coverage insurance includes comprehensive and collision insurance, which pays for damage to your own car. Utah's weather can be harsh and unpredictable all year round, so comprehensive coverage is especially important because it covers damage caused by weather.

Full coverage also typically has higher liability limits than the state requirements. That's important in Utah, where the state requirements may not be high enough to cover the cost of a major accident.

For example, Utah requires only $25,000 of property damage liability to avoid penalties. But if you crash into a brand-new or expensive car, that probably won't be enough to replace it.

Most lenders require you to have full coverage insurance if you have a car loan or lease. You should also consider a full coverage policy if your car is less than eight years old or worth more than $5,000.

Frequently asked questions

Is Auto-Owners cheaper than Geico?

Yes, Auto-Owners offers cheaper average rates than Geico in Utah. The average cost of full coverage from Auto-Owners is $160 a month. Geico is $171 a month.

Who has the cheapest car insurance in Utah?

In 2026, Auto-Owners has the cheapest full coverage car insurance in Utah. The company charges an average of $160 per month. That's about a quarter less than the Utah state average of $224 per month.

Auto-Owners also has the most affordable minimum coverage rates, at $67 per month, on average.

How much is car insurance in Utah per month?

The average price for a full coverage policy in Utah is $224 per month. Minimum coverage car insurance costs an average of $102 per month.

How much is auto insurance in Ogden, UT?

The average cost of car insurance in Ogden is $253 per month for a full coverage policy. That's $29 per month more than the Utah state average.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across Utah for the state's largest auto insurance companies. Rates are for a 30-year-old man with a 2018 Honda Civic EX and good credit.

Full coverage quotes include more liability and PIP than the minimum requirements, as well as comprehensive and collision coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

Minimum coverage rates are for the new liability limits required as of Jan. 1, 2025.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.