Best & Cheapest Car Insurance Quotes in South Dakota (2026)

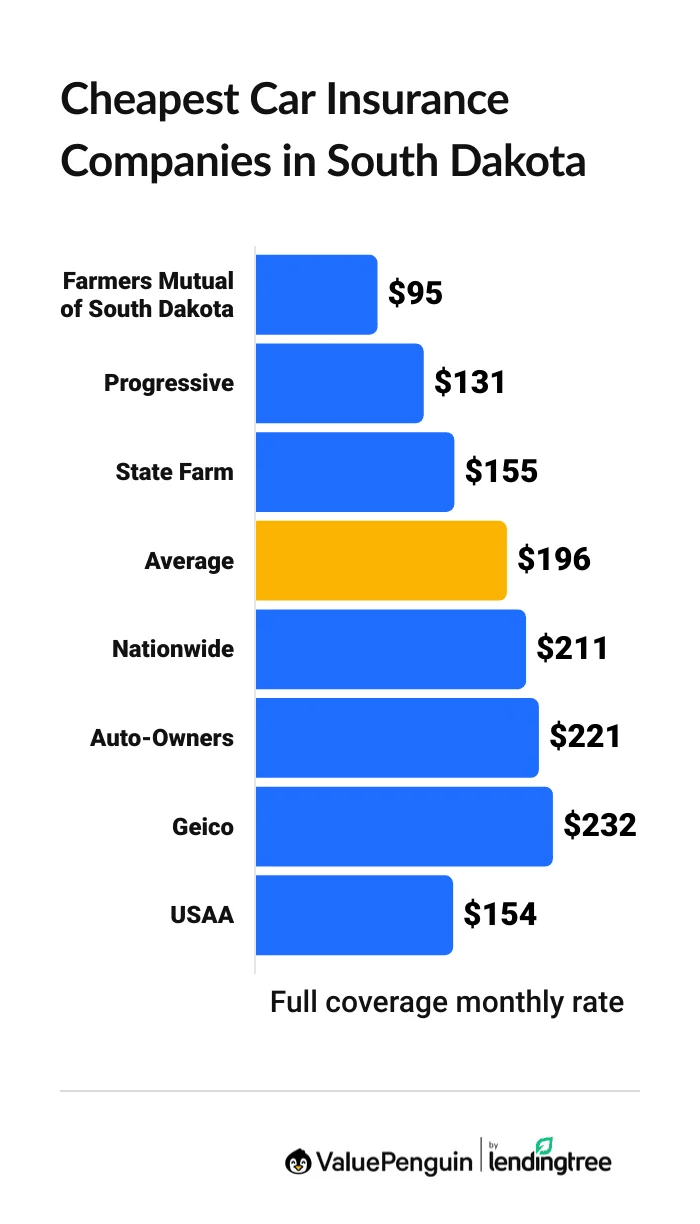

Farmers Mutual of Nebraska has the best cheap car insurance in South Dakota. At $95 per month, full coverage from Farmers Mutual is $101 per month cheaper than the state average.

Find Cheap Auto Insurance Quotes in South Dakota

Best cheap auto insurance in South Dakota

Best and cheapest car insurance in South Dakota

- Cheapest full coverage: Farmers Mutual of Nebraska, $95/mo

- Cheapest minimum liability: Progressive, $16/mo

- Cheapest for young drivers: Farmers Mutual of Nebraska, $46/mo

- Cheapest after a ticket: Farmers Mutual of Nebraska, $113/mo

- Cheapest after an accident: Farmers Mutual of Nebraska, $128/mo

- Cheapest for teens after a ticket: North Star Mutual, $58/mo

- Cheapest after a DUI: Progressive, $159/mo

- Cheapest for poor credit: Farmers Mutual of Nebraska, $144/mo

Monthly rates are based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Farmers Mutual of Nebraska has the best mix of good customer service and affordable rates in South Dakota. Drivers may also want to consider State Farm, which has some of the best customer service in the state.

Cheapest car insurance in South Dakota: Farmers Mutual of Nebraska

Farmers Mutual of Nebraska has the cheapest full coverage car insurance in South Dakota.

Find Cheap Auto Insurance Quotes in South Dakota

- Farmers Mutual of Nebraska has the cheapest rates for most people in South Dakota, at $95 per month for full coverage. That's less than half the South Dakota state average.

- Progressive also offers affordable rates for full coverage car insurance in South Dakota. The company charges an average of $131 per month, which is $65 cheaper than average.

- If you're looking for the best customer service, you may want to consider choosing State Farm. The company gets great reviews and charges an average of $155 for full coverage in South Dakota.

Cheapest full coverage South Dakota car insurance rates

Company | Monthly rate | |

|---|---|---|

| Farmers Mutual of Nebraska | $95 |

| Progressive | $131 | |

| State Farm | $155 | |

| Nationwide | $211 | |

| Auto-Owners | $221 |

USAA is only available to current and former military members and their families.

Data-powered research on South Dakota car insurance

Data-powered research on SD car insurance |

|---|

Cheapest minimum coverage insurance in South Dakota: Progressive

Progressive offers the cheapest minimum liability car insurance in South Dakota for most people.

Minimum coverage from Progressive costs $16 per month. That's $19 per month cheaper than the South Dakota average, which is $35 per month.

Farmers Mutual of Nebraska also offers cheap minimum coverage rates, at just $17 per month. If you already have policies with Farmers Mutual, you may be able to get lower rates with a multipolicy discount.

Cheap liability-only auto insurance rates in South Dakota

Company | Monthly rate |

|---|---|

| Progressive | $16 |

| Farmers Mutual of Nebraska | $17 |

| State Farm | $30 |

| North Star Mutual | $35 |

| Auto-Owners | $41 |

USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in South Dakota

Cheap SD auto insurance for teen drivers: Farmers Mutual of Nebraska

Farmers Mutual of Nebraska has the cheapest minimum liability car insurance in South Dakota for most young drivers. Minimum coverage from Farmers Mutual costs $46 per month for an 18-year-old driver. That's less than half the state average.

Farmers Mutual of Nebraska also has the cheapest full coverage rates for teens. At $178 per month, a policy from Farmers Mutual costs $280 per month less than the South Dakota state average.

Cheapest South Dakota car insurance for teens

Company | Liability only | Full coverage |

|---|---|---|

| Farmers Mutual of Nebraska | $46 | $178 |

| North Star Mutual | $50 | $342 |

| Progressive | $82 | $484 |

| State Farm | $99 | $391 |

| Farm Bureau | $118 | $576 |

USAA is only available to current and former military members and their families.

USAA also might offer affordable rates for teens with military ties. But only military members, veterans and some of their family members can buy car insurance from USAA.

Cheap South Dakota auto insurance after a ticket: Farmers Mutual of Nebraska

Farmers Mutual of Nebraska has the best quotes for South Dakota drivers with a speeding ticket. At $113 per month, full coverage from Farmers Mutual is $126 per month cheaper than the state average for drivers with one speeding ticket.

Company | Monthly rate |

|---|---|

| Farmers Mutual of Nebraska | $113 |

| State Farm | $162 |

| Progressive | $177 |

| North Star Mutual | $265 |

| Auto-Owners | $267 |

USAA is only available to current and former military members and their families.

South Dakota drivers with a speeding ticket pay 22% more for car insurance, on average. That's $43 per month more for a full coverage policy.

Best South Dakota auto insurance rates after an accident: Farmers Mutual of Nebraska

Farmers Mutual of Nebraska has the cheapest car insurance quotes for South Dakota after an accident. A full coverage policy from Farmers Mutual costs $128 per month, which is less than half the state average in South Dakota.

Company | Monthly rate |

|---|---|

| Farmers Mutual of Nebraska | $128 |

| State Farm | $155 |

| Progressive | $202 |

| Auto-Owners | $306 |

| Nationwide | $373 |

USAA is only available to current and former military members and their families.

In South Dakota, a single accident can raise your auto insurance rates by an average of 54%.

Don't worry about shopping for a new policy right after your accident. Your insurance rates won't go up until your current policy renews. However, any quotes you get will consider your accident, so they'll likely be higher than what you're paying now.

Instead, wait until you get your renewal offer, a few weeks to one month before your policy expires. Then, you should compare quotes from multiple companies to find the cheapest rates for you.

Cheap quotes for teens with a ticket or accident: North Star Mutual

North Star Mutual has the cheapest car insurance rates for young drivers with a recent speeding ticket. A minimum liability policy from North Star Mutual costs $58 per month for an 18-year-old driver. That's less than half the South Dakota average.

Farmers Mutual of Nebraska has the most affordable quotes for South Dakota teens after an accident. Minimum coverage from Farmers Mutual costs $74 per month, which is $65 per month cheaper than the state average.

Cheapest SD insurance for teens with a ticket or accident

Company | Ticket | Accident |

|---|---|---|

| North Star Mutual | $58 | $79 |

| Farmers Mutual of Nebraska | $59 | $74 |

| Progressive | $85 | $90 |

| State Farm | $108 | $99 |

| Auto-Owners | $131 | $179 |

USAA is only available to current and former military members and their families.

A speeding ticket increases the average rate for young South Dakota drivers by almost 14%, while rates go up by 30% after an accident.

Cheap auto insurance in South Dakota after a DUI: Progressive

Progressive has the cheapest quotes in South Dakota after a DUI. At $159 per month, a full coverage policy from Progressive is half the South Dakota average.

Affordable South Dakota auto insurance quotes after a DUI

Company | Monthly rate |

|---|---|

| Progressive | $159 |

| Farmers Mutual of Nebraska | $183 |

| State Farm | $276 |

| Auto-Owners | $396 |

| Nationwide | $499 |

USAA is only available to current and former military members and their families.

Drivers in South Dakota can expect their insurance rates to more than double after a DUI.

In addition, most drivers must get SR-22 insurance after a DUI. Insurance companies charge between $15 and $50 to file an SR-22 form on your behalf. That's on top of any increase to your insurance rates.

Best car insurance in South Dakota for drivers with poor credit: Farmers Mutual of Nebraska

Farmers Mutual of Nebraska has the cheapest quotes for South Dakota drivers with a poor credit score, at $144 per month for full coverage. That's $284 per month cheaper than the state average.

Company | Monthly rate |

|---|---|

| Farmers Mutual of Nebraska | $144 |

| Progressive | $205 |

| Geico | $331 |

| Nationwide | $363 |

| North Star Mutual | $440 |

USAA is only available to current and former military members and their families.

In South Dakota, drivers with poor credit pay more than twice as much for full coverage insurance as those with a good credit score. Credit scores can affect your insurance rates because insurance companies believe that drivers with bad credit scores are more likely to file a claim in the future.

Best car insurance in South Dakota

USAA has the best-rated car insurance in South Dakota based on its reliable customer service and cheap rates.

However, only military members, veterans and their families can buy car insurance from USAA.

State Farm, Farm Bureau and North Star Mutual are also good options for South Dakota drivers. These companies have fewer customer complaints than average for their size.

Top South Dakota auto insurance companies

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 735 | A++ | |

| State Farm | 650 | A++ | |

| Farm Bureau | 645 | A | |

| North Star Mutual | A+ | ||

| Nationwide | 645 | A |

Car insurance rates in South Dakota by city

Watertown, a city in northeastern South Dakota, has the cheapest car insurance rates in the state.

Drivers in Watertown pay an average of $161 per month for full coverage car insurance.

Allen, located on the Pine Ridge Indian Reservation, has the most expensive rates in the state, at $258 per month.

Average SD car insurance quotes by city

City | Monthly rate | % from average |

|---|---|---|

| Aberdeen | $168 | -15% |

| Agar | $203 | 3% |

| Agency Village | $178 | -9% |

| Akaska | $197 | 0% |

| Alcester | $170 | -13% |

Average full coverage quotes in South Dakota vary by up to $97 per month, depending on where you live. Quotes can vary depending on the types of risks that are common where you live. For example, if you live in an area with a large number of uninsured drivers or experience more severe winter weather than other locations, you'll likely pay more for insurance.

What are South Dakota's minimum requirements for auto insurance?

Drivers in South Dakota must have a minimum amount of liability coverage, sometimes written as 25/50/25. You must also have matching uninsured and underinsured motorist bodily injury liability limits.

- Bodily injury (BI) liability: $25,000 per person and $50,000 per accident

- Property damage (PD) liability: $25,000 per accident

- Uninsured and underinsured motorist (UM/UIM) bodily injury liability: $25,000 per person and $50,000 per accident

What's the best car insurance coverage for SD drivers?

Full coverage car insurance is the best choice for most drivers in South Dakota.

That's because minimum liability policies may not have enough protection to cover the cost of an accident. Say you crash into and total a new car. $25,000 of property damage liability coverage likely won't be enough to replace it. So if you have a minimum coverage policy, you'll have higher out-of-pocket expenses.

In addition, minimum liability policies don't protect against damage to your car. Full coverage includes comprehensive and collision coverage, which pay for damage to your car after most accidents, thefts, natural disasters and vandalism.

Most lenders require you to have comprehensive and collision coverage if you have a car loan or lease. You should also consider adding these coverages if your car is less than 8 years old or worth more than $5,000.

Frequently asked questions

How much is car insurance in South Dakota?

A full coverage policy costs $196 per month in South Dakota, on average. Drivers can expect to pay $35 per month for a minimum liability policy.

Who has the cheapest car insurance in South Dakota?

Farmers Mutual of Nebraska has the cheapest quotes for most South Dakota drivers looking for full coverage policies in 2026. Full coverage from Farmers Mutual costs $95 per month. Progressive offers the cheapest minimum liability coverage at just $16 per month. That's less than half the statewide average.

How much is car insurance in Sioux Falls, SD?

The average cost of car insurance in Sioux Falls is $174 per month for a full coverage policy. That's $22 per month less than the South Dakota average.

Is car insurance more expensive in South Dakota?

South Dakota has the second-cheapest minimum coverage quotes in the country, at $35 per month. This is partially due to South Dakota's low rate of car accident fatalities. Its low population density also means less traffic on the roads, which leads to fewer accidents.

How can I make my car insurance claim process easier in South Dakota?

To make the claims process easier after an accident in South Dakota, you should start by checking your policy to make sure the damage is covered. Then, file your claim as soon as possible and include photos, the police report and any other helpful info.

Methodology

ValuePenguin collected thousands of rates from ZIP codes across South Dakota for the largest insurance companies in the state. Rates are for a 30-year-old man with good credit who drives a 2018 Honda Civic EX.

Quotes for full coverage include higher liability limits than the state requirement, along with collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $50,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Senior Writer

Lindsay Bishop is a Senior Writer at ValuePenguin, where she educates readers about home, auto, renters, flood and motorcycle insurance.

Lindsay began her career in the insurance and financial industry in 2010. She was a licensed auto, home, life and health insurance agent and held Series 6 and 63 financial licenses.

After a hiatus from the financial sector, Lindsay returned to the industry as a content writer for ValuePenguin in 2021. She enjoys having the opportunity to help readers make smart decisions about their insurance so they can be prepared for anything life throws their way.

When Lindsay isn't writing about insurance, you can find her spending time with family, enjoying the outdoors on Sunday long runs or riding her Peloton.

How insurance helped Lindsay

As a homeowner for 15 years located in South Carolina, Lindsay has plenty of experience navigating the coastal insurance market and managing the claims process. That includes successfully negotiating a full roof replacement claim.

Expertise

- Home insurance

- Car insurance

- Flood insurance

- Renters insurance

- Motorcycle insurance

Referenced by

- CNBC

- Yahoo Finance

- Miami Herald

Education

- BS/BA Economics, University of Nevada Las Vegas

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.