Chubb Insurance Review: Outstanding Coverage and Service, At a Price

Chubb Insurance is a good option for expensive homes and cars with policies up to $100 million, and top-notch service.

intro Chubb’s policies are best if you have a high net worth and own expensive cars or properties. The company offers outstanding coverage with liability limits in the millions. You can also pick add-on options that most other companies don't have, such as risk consulting and family protection.

But if you're looking for cheap insurance, consider another company. Most standard companies offer more affordable rates.

Find Cheap Homeowners Insurance Quotes in Your Area

Editor's rating | |

|---|---|

| Price | |

|

Unique value |

Pros and cons

Pros

Coverage options tailored to higher-value homes

Great customer satisfaction

Personalized service

Cons

Expensive rates

No online quotes

Chubb car insurance

Chubb offers premium auto insurance at a premium price.

Chubb car insurance policies have high levels of protections plus uncommon coverage options. But rates are expensive.

Chubb auto insurance quotes

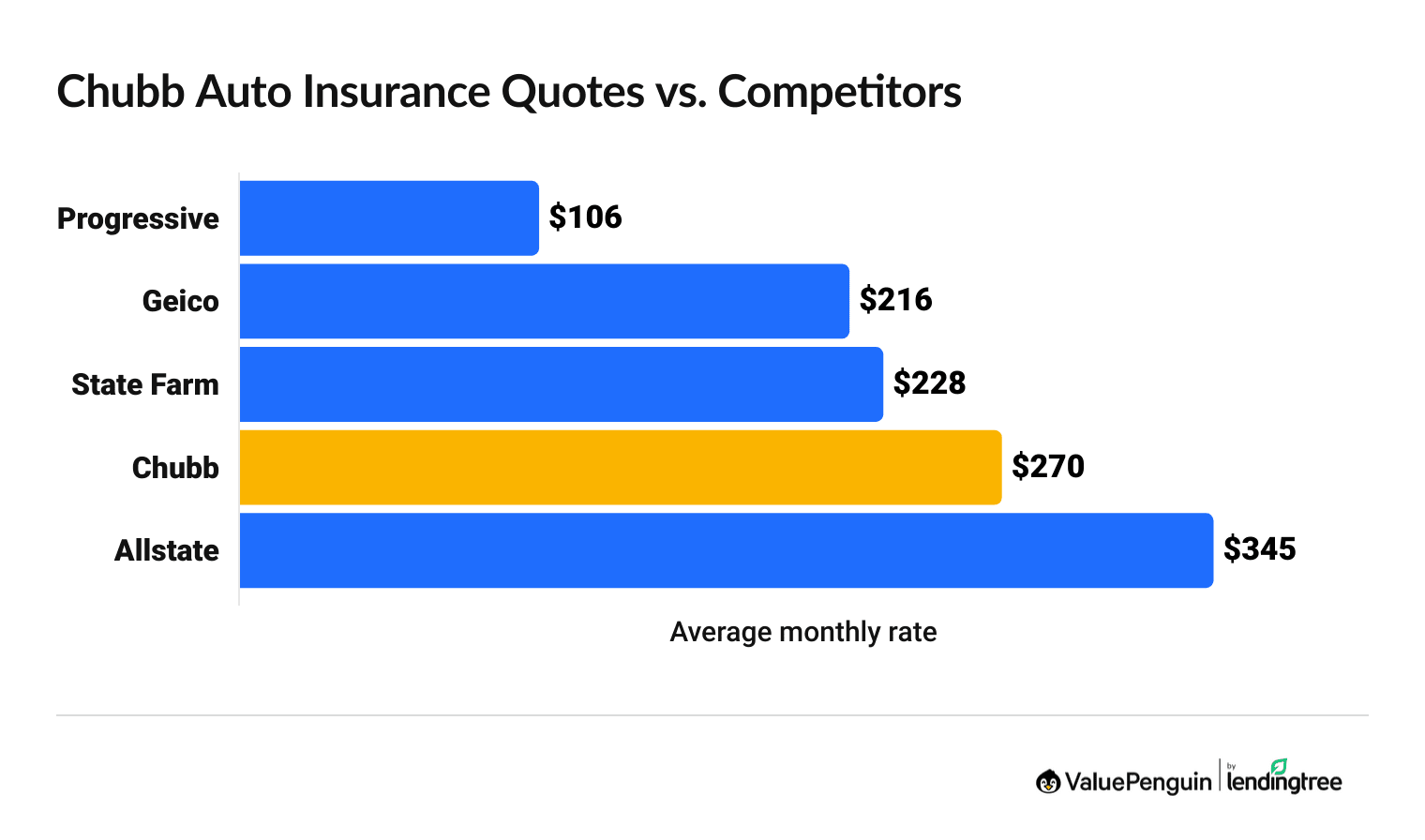

Chubb has some of the most expensive car insurance rates.

If you're looking for cheap auto insurance, consider another company. You’ll pay an average of around $270 a month for full coverage, which is more than double the cheapest option nationally. Progressive's average rate is $106 per month. Geico and State Farm are also cheaper at $216 and $228 monthly.

Find Cheap Auto Insurance Quotes in Your Area

Chubb car insurance rates vs. competitors

Company | Monthly rate | |

|---|---|---|

| Progressive | $106 | |

| Geico | $216 | |

| State Farm | $228 | |

| Chubb | $270 | |

| Allstate | $345 |

Chubb cheaper-than-average rates for teens. Its rates for 18-year-old drivers are 9% cheaper than average.

Rates for teens

$606/mo

$667/mo

Rates after an accident

$319/mo

$275/mo

Rates after a ticket

$331/mo

$264/mo

Always be sure to compare auto insurance quotes to find the cheapest policy, as rates vary by where you live and your driving history.

Chubb auto insurance discounts

Chubb offers a typical set of auto insurance discounts. For example, parents adding a child to their policy may be able to save with good student and multicar discounts.

Available discounts include:

- Safe driving with Chubb SafeLane

- Multipolicy - auto and home

- Good student

- Driver training

- Accident prevention course

- Air bag/passive restraint

- Anti-lock brake

- Anti-theft

- Multicar

- Daytime running lights

Chubb auto insurance coverage options

Chubb stands out for offering several rare add-ons and coverage for $10 extremely high-value cars.

Chubb’s auto insurance is called Masterpiece. You have the option to get a much higher level of protection than most companies offer. One of the perks is that any repairs done at Chubb-certified shops have a lifetime guarantee.

Agreed value coverage allows you and the insurance company to agree what your classic or exotic car is worth when you first get coverage. Insurance companies often don’t properly value these cars. Then, if your car is totalled, you'll receive the agreed amount.

Roadside assistance pays for towing, a locksmith, gas delivery, flat tire changes and other such services.

Pays to replace lost, stolen or damaged keys or locks, without any deductible or out-of-pocket expense.

If your car is totaled, Chubb will remove any personally identifiable info remaining in its system. This way your address, garage code or favorite map routes won’t be available for someone to grab.

Pays for parts made by your car’s manufacturer. These tend to be more expensive than parts bought on the open market.

Chubb has special coverage options for vintage or collector cars. You can drive it for unlimited miles when going to a car show.

Boat and yacht coverage

Chubb offers insurance on boats 35 feet or less and on yachts 36 feet or more.

Rental car coverage

Chubb has claim teams in 54 countries and covers repairs to a rental car almost anywhere in the world.

There is no per-day rental limit on rental cars if you need one while yours is being fixed. The total limit is $15,000.

Chubb homeowners insurance

Chubb offers wide and robust coverage on standard homeowners insurance.

Chubb’s home insurance rates are high, but its coverage, customer service and add-ons stand out compared to larger insurance companies.

If you have an inexpensive home, Chubb’s coverage may be too much.

Find Cheap Homeowners Insurance Quotes in Your Area

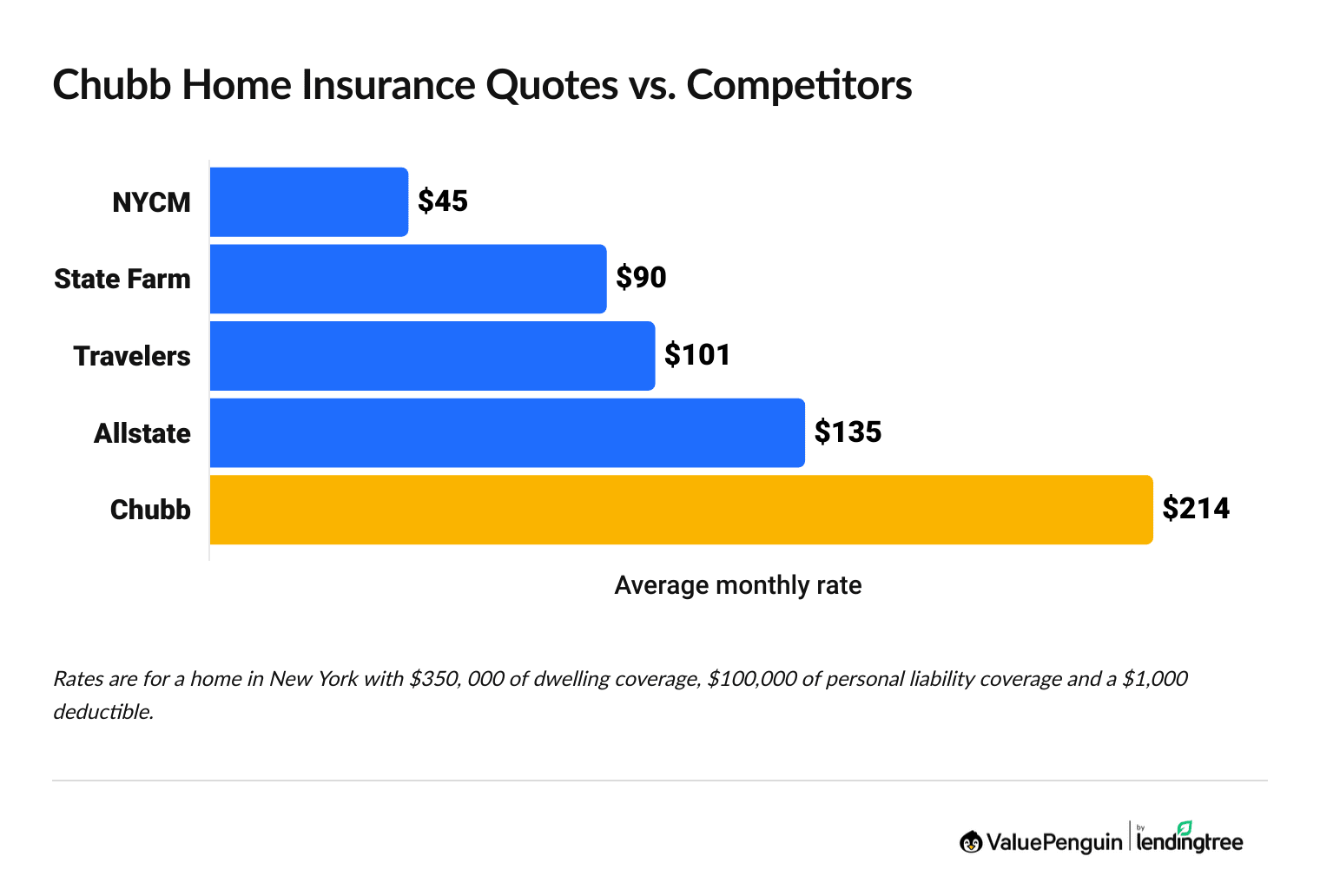

Chubb homeowners insurance quote comparison

Chubb specializes in robust customer service.

Chubb home insurance rates vs. competitors

With Chubb home insurance, you'll have access to standout features such as risk consulting. But that comes at a higher price point.

Chubb homeowners insurance discounts

Chubb has a wide range of discounts, depending on your home and where you live.

Some discounts are relatively cheap and easy: You could save money by having storm shutters, which can cost $32 per window. Others are much more expensive, such as having a caretaker who lives on your property.

Chubb also offers a Superior Protection Discount for people who have any combination of the following to protect their home:

Chubb homeowners insurance coverage

Chubb offers a lot of coverage options, especially for people who have high net worth.

You can get high coverage limits on standard homeowners insurance and several uncommon add-on coverage options such as risk consulting. Many of these policy benefits are unusual, even with large companies. But you might not be able to get them in every state.

Extended replacement cost

When the cost to fully repair, rebuild or restore your property goes beyond the coverage you purchased, this coverage will pay for it, including any building code upgrades.

Risk consulting

This includes home appraisals as well as security and fire prevention advice. For example, a consultant could recommend removing a woodpile and installing cameras or a sprinkler system.

Replacement cost coverage

Fully pays to replace your appliances and fixtures with the same or newest model. Homeowners can also choose a cash settlement instead of paying for repairs or a new item.

Wildfire Defensive Services

Helps homeowners in certain states protect their home from wildfires. It also includes support after a fire and during the claims process.

Cyber insurance

Pays for the full replacement or repair of your home's appliances and equipment after sudden and unexpected damage.

Appliance and equipment breakdown

Helps customers pay for expenses following traumatic events like home invasion, carjacking or cyberbullying.

Family protection

If you cover your second or seasonal home with Chubb, the company will automatically inspect the home after a catastrophic event like a hurricane. With your permission, it will perform short-term repairs and submit claims.

Property Manager service

Cyber insurance helps to prevent and respond to cyber attacks. Coverage can include the cost to replace data and hire public relations, legal and digital forensic teams.

Valuable articles

Covers specific items such as fine art, jewelry, collectibles, musical instruments, furs, designer clothing, designer purses and electronics.

You may also be able to add some of these protections to a condo, co-op or renters policy.

Other Chubb Insurance options for your home

Chubb condo and co-op owners insurance coverage

Chubb's condo and co-op insurance stands out because it includes protection for damage to common areas, like the pool or lobby. It’s usually an add-on coverage at other companies.

Chubb's base coverage is $50,000 for common areas, and higher limits are available in some states.

Chubb renters insurance coverage

One unusual add-on is Chubb also offers rental car coverage with its renters insurance. If your liability limit is $1 million or more, you get worldwide rental car coverage. That means you're protected no matter where you travel.

Chubb flood insurance coverage

Chubb flood insurance is a good choice if you have an expensive home in a high-risk area.

Chubb is one of the few companies that offer private flood insurance. Its coverage is more comprehensive and its limits are higher than the government-sponsored National Flood Insurance Program.

Chubb flood insurance coverages include:

- Up to $15 million in property coverage.

- The full replacement cost to repair or rebuild your home and belongings without deductions for depreciation, up to your policy limits. NFIP policies only offer

- actual cash value

- for personal property.

- Up to $5,000 for categories of expensive things, such as art, collectibles, jewelry and silverware, up to $5,000 each.

- Up to $7,500 in temporary living expenses, with higher limits available for an extra fee. While some other private flood insurance policies may cover this, NFIP policies do not.

- Up to $5,000 to protect your home from storms. This includes expenses like sandbags and flood barriers to protect your home when an official flood warning is issued. This type of coverage is rare for flood insurance companies.

- Extra protection for finished basements.

Chubb insurance customer service and ratings

Customers can expect excellent customer service with Chubb.

For home insurance claims satisfaction, Chubb has few complaints.

According to the National Association of Insurance Commissioners, Chubb received 52% fewer complaints than expected for a company of its size.

Customers shouldn't worry about whether Chubb will have enough money to pay out their insurance claims. Chubb received an A++ financial strength rating from A.M. Best. That means even if a natural disaster totals hundreds of homes, Chubb will be able to pay.

Frequently asked questions

Is Chubb Insurance good?

Chubb Insurance is a good option for people with high net worth who want high levels of coverage.

Is Chubb a top company?

Chubb is a top company for high-limit coverage and customer satisfaction. But it isn’t big like Progressive or State Farm.

Who owns Chubb Insurance?

ACE Limited bought Chubb Insurance in 2016. The whole company now goes by the name Chubb. It’s listed on the New York Stock Exchange under the ticker CB.

Methodology and sources

Auto insurance

To compare auto insurance rates, ValuePenguin gathered quotes from all New York ZIP codes. Quotes included:

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Personal injury protection: $50,000

- Collision and comprehensive coverage: $500 deductible

Home insurance

To compare homeowners insurance rates, ValuePenguin gathered quotes from ZIP codes across New York. Quotes included the following limits:

- Dwelling coverage: $350,000

- Personal liability: $100,000

- Medical payments: $5,000

- Deductible: $1,000

Flood insurance

Average rates for private flood insurance are based on nationwide data from S&P Global for the 2023 plan year. Rates are an average of what policyholders currently pay and are not standardized based on property values.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

To calculate our ValuePenguin editor's rating, our editors considered cost, availability of coverage options, customer service reviews and overall value provided to customers.

Sources include Chubb, J.D. Power, AM Best and the National Association of Insurance Commissioners.

Senior Writer

Jenn Jones is a Senior Writer at LendingTree where she covers auto, home, renters and motorcycle insurance topics.

Previously an editor for USA TODAY Blueprint and a finance manager at World Car dealerships, she has more than a decade of experience in the world of personal finance and a deep interest in sharing knowledge that empowers others. She’s also served as a freelance translator, copy editor, writer and researcher. She graduated from the University of Virginia with a B.S. in commerce and a B.A. in Chinese language and literature.

How insurance helped Jenn

Jenn first came to appreciate pet insurance when annual checkups for her cat and dog totaled more than $700.

Expertise

- Auto insurance

- Renters insurance

- Condo insurance

- Home insurance

Referenced by

- USA TODAY

- MSN

- F&I Magazine

- Automotive News

Education

- BS, Commerce, University of Virginia

- BA, Chinese Language and Literature, University of Virginia